Types of Index MAs Moving Averages - SMA, EMA, LWMA & SMMA

There are 4 types of Stock Index moving averages:

- Simple moving average

- Exponential Indices moving average

- Smoothed Index moving average

- Linear weighted Index moving average

The difference between these 4 moving averages is the weight assigned in to the most recent price data.

Simple Moving Average - SMA Indicator

The Simple Moving Average (SMA) indicator for Stock Indices assigns equal significance to all Index data points utilized in its calculation. This average is determined by summing the price points across a specified period on an Index chart and subsequently dividing that sum by the total count of those price periods. As an example, a 10-period Simple Moving Average (MA) sums the price data from the preceding 10 periods and divides the result by 10.

Exponential Moving Average - EMA Indicator

Stock The Index EMA indicator prioritizes more recent price information in its calculation, assigning greater significance to the latest price values through a percentage P multiplier used to emphasize the most current data points.

Linear Weighted Moving Average - LWMA Indicator

Stock Index LWMA indicator MAs applies more weight to the most recent price data and the latest data is of more value than earlier price data. Linear Weighted Index MA is calculated by multiplying each of the closing price within the series, by a certain weight coefficient.

Smoothed Moving Average(MA) - SMMA Indicator

Stock Index SMMA Indicator is found by using a smoothing number of N, and the smoothing number is based on N smoothing for N price bar times.

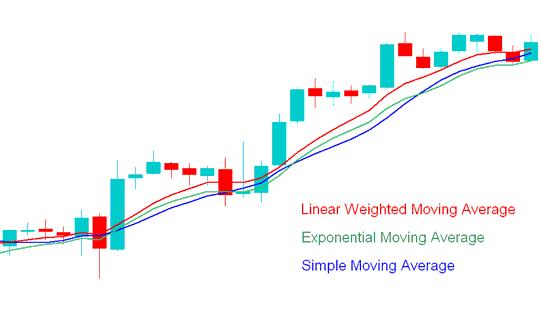

The accompanying chart displays the Simple Moving Average (SMA), Exponential Moving Average (EMA), and Weighted Moving Average (LWMA). The SMMA Index moving average is infrequently employed and is therefore not represented here.

LWMA Indicator Responds Quickest to Price Changes, Then EMA, Followed by SMA.

SMA, LWMA, EMA - Types of Index MAs - SMA, EMA & LWMA

Intraday Index Trading Using Exponential and Simple Moving Averages (MAs)

The SMA & EMA Index moving averages are the most commonly used Moving averages to trade Indices. Whereas the EMA Index moving average has got a more sophisticated formula of calculation, its more popular than the SMA Index moving average.

Simple Moving Average is just the arithmetic mean of closing prices over a set timeframe. Add up the closing prices for your chosen number of periods - say, the last ten - and divide by ten. That's your average.

The SMA indicator uses a simple arithmetic mean. It's straightforward, and a lot of Stock Index traders link it to the trend because it closely follows index price action.

EMA on the other hand uses an acceleration factor and it's more responsive to the trend.

The SMA Index moving average is used in Index charts to analyze and interpret price action. If price action in more than 3 or 4 time price bars periods the SMA then its an indication that long Index trades should be closed immediately & the bullish momentum of the buy trade is waning.

The shorter the time frame for the SMA, the quicker it will react to changes in the price of indices. The SMA tool can show information about the price trend and how fast it's moving by looking at its slope: the steeper the SMA slope, the stronger the trend.

Index traders often use Exponential Moving Average like stock traders. It responds quicker to market changes, so some prefer it for Stock Indices.

SMA and EMA help spot entry and exit in index trading. Pair them with Fibonacci or ADX for signal checks.

Learn More Topics and Courses:

- Instructions for Finding and Accessing the SX 5E Index on the MT5 Application

- How to Trade SPAIN35 Stock Index Strategy Guide Tutorial

- Fibonacci Extension: Index Chart Levels

- A List of Stock Index Brokers Offering MT4 Stock Index Program/Platform

- How Do You Set S&P ASX 200 on MetaTrader 4 App?

- SX5E MetaTrader 5 Forex Platform Software

- Using the Ehler Laguerre Relative Strength Index as a Trading Tool