Stock Index Trading System

The Best method of trading index is to use a trading system and combine it with the pullback entry strategy. This is the best method to ensure that your risk: reward is high enough thus improving your chance of making more profits from trading index charts.

The Pull Back - Retracement

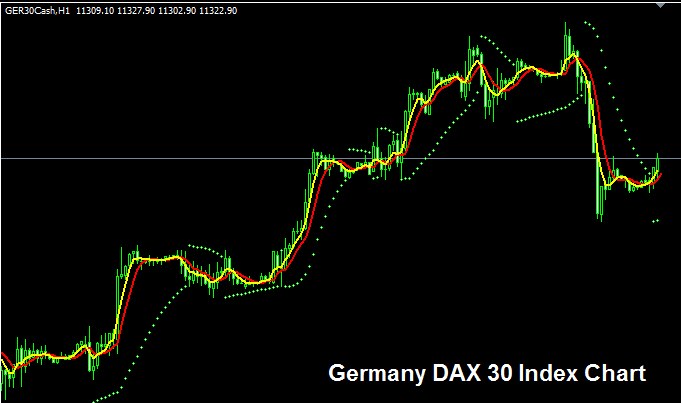

As a trader even before implementing you trade system you want to wait for a pull back, but how does a pullback look like - The price pullback is displayed and illustrated below.

In the above example the chart is of Germany DAX 30 - The 1 Hour chart timeframe is used to look for a price pullback. In this index chart the long term trend is upwards - in addition the main fundamental strategy that's being used for Germany DAX 30 & all European Stock Indices at the time of writing is QE - which means Quantitative Easing - we shall explain this on our market sentiment for indices tutorial. For now let's continue with the explanation of our trading strategy.

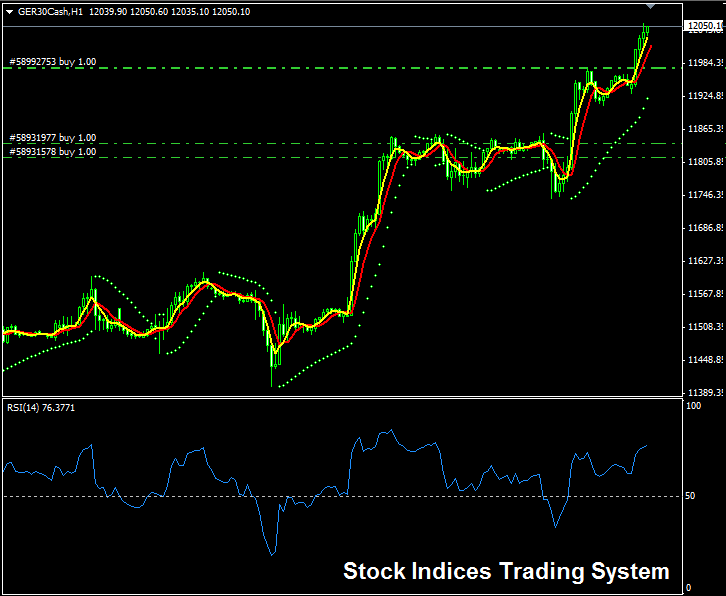

For the above setup, you can see there was a pullback on this index, but now the moving averages have turned and are starting to move upwards - this is our entry signal where as a trader you open a buy trade on this index. You can also add another indicator like the RSI to confirm this signal.

From the above example - we waited for a price pullback, this pullback quickly reversed and the upward trend continued, moving average indicator turned up & RSI indicator moved to above 50 confirming our buy signal, a buy trade was then opened at the level of 11,810 & this upwards trend continued up to the index level 12,050. All these time our stock indices trading system shows the upward trend was gaining momentum as the two technical indicators, Moving average crossover method kept moving up & the RSI trading indicators remained above 50 mark - RSI levels above 50 means that prices are closing higher than they opened.

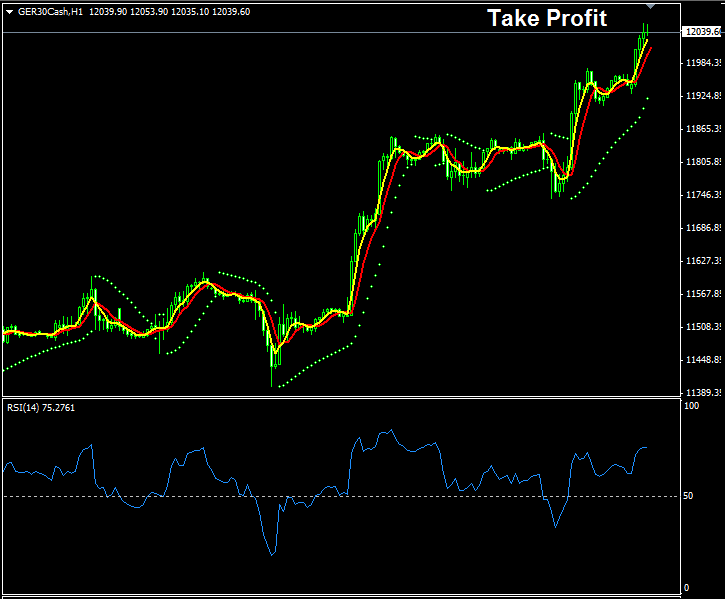

Take Profit

At the same time on this setup, since our trades are in profit, we want to take profit while we are still ahead. Note that our trading system is showing the market signal is still a buy but because we want to book our profit while ahead we shall close this trade. This trade has moved 2,400 points in our favor making a profit of 236 dollars per lot. We had opened 2 lots making a total profit of about $560 dollars, we had also added 2 more lots at 11,980 & for these we made some additional 700 points profit.

Remember for Stock indices 1 pip per lot is equal to 0.1 dollars and not 10 dollars per pip like in Forex. However, market daily market moves for indices is about 500 to 2000 points while forex daily pip movement is average of 50 to 100 points - therefore in stock indices even though the market moves are about 2000 points, profit per point is only 0.1 dollars - therefore when trading indices if you make a profit of 2000 point the total profit in dollars is only $200 dollars like the example above.

The other point is that the average lot for indices is lower than the standard forex lot, while the forex lot requires a margin of $1,000 dollars, a standard lot for the above trade require only € 85(about $ 90), this means the standard lot in Stock Indices is 10 times smaller than that one in Forex - Therefore the lot used in the above trade is the equivalent of a forex mini lot.

The screenshot below shows out index trade chart after we have closed our trade and taken our profits.

The Trading System Specifications

Indicators

- 5 & 7 LWMA - Moving Average Crossover Method

- RSI - 50 Center Line Crossover Method

Trading Rules

- Wait For Pullback

- After Pullback, look for entry signal - Both MAs Moving Averages should be moving upward and RSI should be above 50 center mark.

Remember the long term trend for this stock index is upwards, therefore we only open buy trades (The Trend is Your Friend).