Money Management in Indices - Drawdown & Maximum Drawdown

In stock index one of the most crucial concepts is money management; how do you as a trader manage your account so that as you make profits in the long-term.

To know about money manage you are required to know the following concepts as a trader.

Draw-down

Drawdown is the amount of money you can lose on a single trade in stock index.

Example of Drawdown:

Say you have $10,000 in your account and you open a trade. If you lose $1,000 on that single trade, that's your drawdown.

Drawdown Equals $1,000 Divided by $10,000 Times 100, or 10% of Account

Maximum Drawdown

Maximum draw-down represents the total cumulative loss experienced in your trading account before you transition into a profitable state.

Example of Maximum Drawdown:

If you have $10,000 and experience three losing trades totaling $3,000 before achieving four winning trades yielding $4,000, your maximum drawdown reflects your negative balance due to losses.

Maximum Draw-down = $3,000/$10,000100 = 30% of your account

To better manage your money as trader it's best to keep this drawdown per trade to a minimum. The recommended is 2 % draw-down per trade. This way as a trader you'll control the risk per trade & also minimize the maximum drawdown.

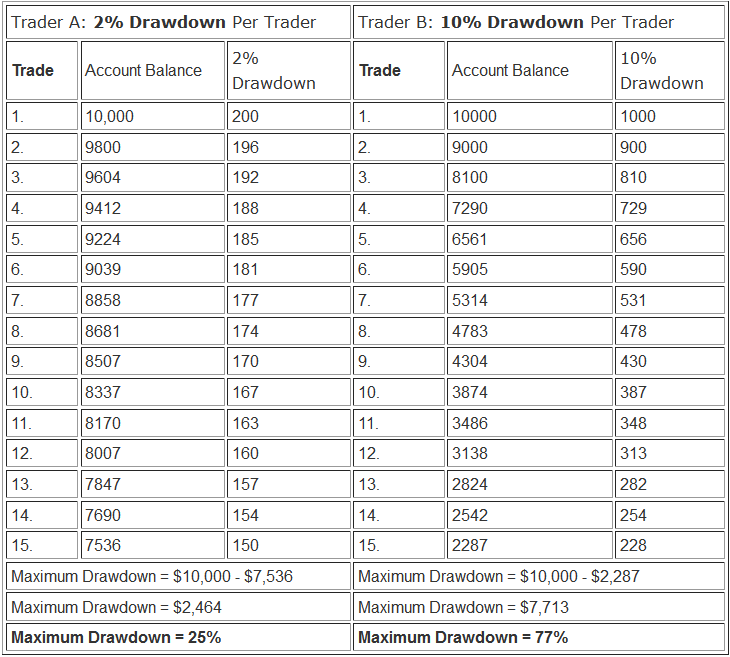

For Example if there are two traders one uses 2 % drawdown per trade & the other uses 10 % drawdown per trade position, if both of them make 15 losing trade positions in a row, then the 2 accounts will be such as shown & shown below:

A trader who loses 15 trades in a row with a 2% drawdown would still have 75% of their money, but a trader with a 10% drawdown would only have 23%.

This example, while it's not very likely you'd lose 15 trades in a row, shows that risking only 2% of your money will protect it and help you stay in the trading game longer, so you're more likely to earn money over time.

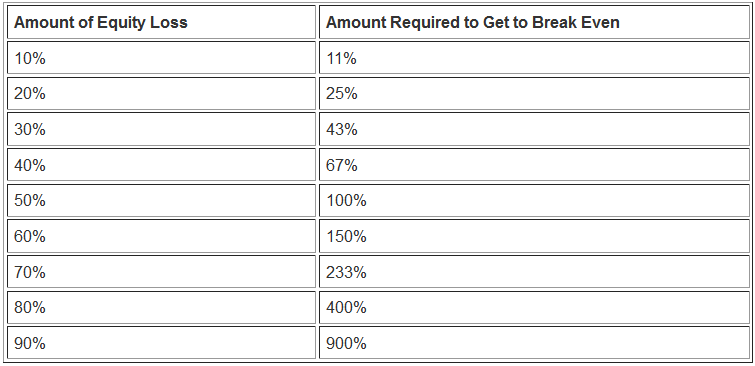

It is easier to recover from a small loss in capital compared to a significant one, as seen in the example below.

Break-Even Calculation in Percent Works This Way

A 10 percent loss on $10,000 means your capital drops to $9,000, requiring an earn of $1,000 to revert to $10,000.

Therefore, 1,000 divided by 9,000 multiplied by 100 equals 11 %

30 % loss for $10,000 your capital is $7,000 dollars you need to earn $3,000 dollars to get to $10,000

Hence $3000/$7,000*100 = 43 %

If You Start with a $10,000 Capital and Experience a 70% Drawdown, Leaving You With $3,000, You Must Earn $7,000 to Recoup Your Initial Investment.

Thus, 7000 divided by 3,000 multiplied by 100 equals 233%.

Looking at these examples, the more you lose, the harder it is to get back to even and make money.

Use a 2% risk per trade to limit drawdowns. This keeps losses small and boosts your profit chances.

Obtain Further Instruction Sets and Programs:

- Technical Breakdown of Trend Trading in Markets

- How Can You Find SX 5E Index on MetaTrader 4 App?

- Strategy for SWI 20 Index

- How to Add US500 on MetaTrader 4 App

- UKX 100 Trading Strategy: A Guide to Developing a Stock Indices Strategy for UKX100 Lessons

- Index Money Management Method

- Downloading MetaTrader 4 Stock Index Software on an IOS Device

- Best Index Trade Software for MAC PC

- Chart Time-frames for Indices

- How Do I Trade Indices & Add Index Symbol in MetaTrader 5 App?