Money Management Methods - Stock Index Money Management Strategies

In there are two money management methods commonly used to manage the account capital in a traders account.

The two equity management strategies are:

1. Risk: Reward Ratio

2. Percentage Risk Method

Risk: Reward Ratio

The risk: reward ratios means that as trader you only trade when you're likely to make more profits, for example if you have a risk: reward ratio of 3:1 then it means that you will only trade when you're likely to make profits 3 times as compared to not making profits.

Or put in another way you are more likely to make 3 times what you risk in a single trade. This means that if you risk $100 then you're likely to make $300 dollar in profit on that trade.

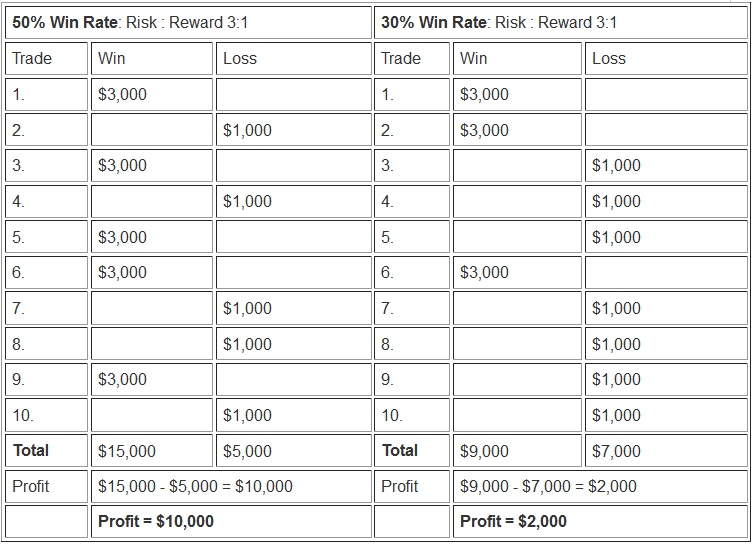

Having a high risk: reward ratio will improve your chances of making more profit when trading the market, for example even if your system win rate is 50 % or even 30 %, you will still make profits if you have a good risk: reward ratio as shown in the illustration below:

From this example if your trade system win rate is 50 % & your risk reward is 3:1 then from ten trades that you will have made your profit would have been $10,000 dollars, even if your system win rate was lower than this and for example your win rate was 30 % you still would have made a profit of $2,000 from the few winning trades as shown above.

Percentage Risk Method

This method a trader will set a fixed percent to risk per trade, therefore a trader might decide to risk only 2 % per trade, this way their risk is always kept to a minimum.

Therefore if a trader has a $50,000 dollar account, amount to risk per trade is about $1,000 dollars, therefore depending on the trade transaction open a trader will set the stop at this amount of $1,000:

For example:

If the trader opens is trading the Italy FTSE MIB 40 or IT40Cash which has a pip value of € 1 & one pip move is equal to 1 point then the trader would calculate the percent risk money management depending on the lots opened as shown below

Example 1:

If the trader opens 1 Lot & 1 point move is equivalent to € 1 which is equal to $1.2, then the trader would calculate the points where to place a stop on their trade as illustrated below:

1 Lot equals € 1 per 1 pip move ($1.2)

$1,000 dollars/$1.2 (€ 1 is equivalent to $1.2) equals 833 points

The trader would set their stop 833 pips away

Example 2:

3 Lots equals € 3 per 1 pip move ($3.6)

If the trader opens 3 Lot & 1 point move is equal to € 3 which is equivalent to $3.6, then the trader would calculate the points where to place a stop on their trade as shown below:

$1,000/$3.6 (€ 3 is equal to $3.6) equals 277 points

The trader would set their stop 277 pips away

Example 3:

5 Lots equals € 5 per 1 pip move ($6)

If the trader opens 5 Lots and 1 point move is equal to € 5 which is equal to $6, then the trader would calculate the points where to place a stop on their trade as illustrated below:

$1,000 dollars/$6 (€ 5 is equivalent to $6) equals 166 points

The trader would set their stop 166 pips away

Example 4:

10 Lots equals € 10 per 1 pip move ($12)

If the trader opens 10 Lots and 1 point move is equal to € 10 which is equal to $12, then the trader would calculate the points where to place a stop on their trade as shown below:

$1,000/$12 (€ 10 is equal to $12) equals 83 points

The trader would set their stop 83 pips away

This also means the less the lots a trader opens, more the pips a trader has when it comes to setting the stops. If a trader opens 1 lot then he can set the stop up to 833 pips and still be within the 2 % percent risk rule, while if the trader opens 10 lots then they will have to set the stops at only 83 points away so that to be within the 2 % risk management rule.