Balance of Power Indices Analysis & Balance of Power Trading Signals

Developed by Igor Livshin

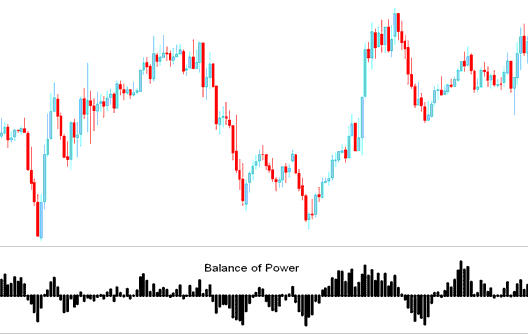

Balance of Power indicator measures the strength of the bulls versus the bears by assessing ability of each to push stock indices price to extreme levels.

Stock Indices Analysis and Generating Trade Signals

When using this technical indicator, the zero line crossovers are used to generate trade signals.

Center is marked as the zero line, levels oscillating above or below are used to generate trade signals.

Buy - The scale is marked from Zero to +100 for bullish market movements

Sell - The scale is marked from Zero to -100 for bearish market movements

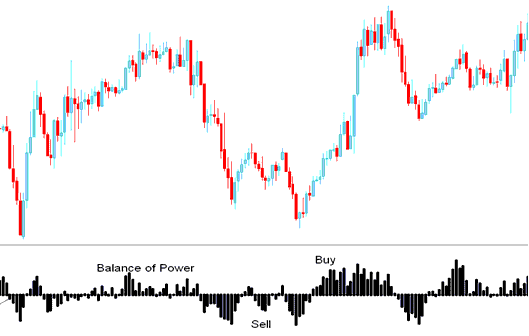

How to Generate Buy and Sell Trading Signals

Buy Signal

When the BOP crosses above the zero a buy stock indices trade signal is given.

Also when the BOP is rising, the stock indices trading market is in an upward trend, some traders use this as a buy stock indices signal but it is best to wait for the confirmation by moving above the zero mark. As this will be a buy stock indices signal in bearish territory and this type of signal is more likely to be a indices whipsaw.

Sell Signal

When the BOP crosses below the zero a sell stock indices trade signal is given.

Also when the BOP is declining, the stock indices trading market is in a downward trend, some traders use this as a sell stock indices signal but it is best to wait for a confirmation by moving below the zero mark because this will be a sell stock indices signal in bullish territory and this type of signal is more likely to be a indices whipsaw.

Sell and Buy Trading Signals

Divergence Stock Indices Trading

In indices trading, divergences between the BOP and stock indices trading price can be used to effectively spotting potential reversal and/or trend continuation points in the stock indices price movement. There are several types of divergences:

Classic Divergence - Indices Trend reversal indices signal

Hidden Divergence - Indices Trend continuation

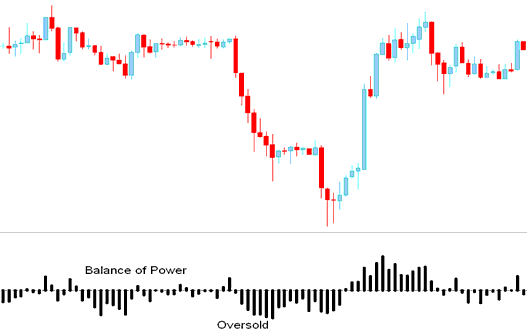

Indices Overbought Oversold Conditions

This Balance of Power can be used to identify potentially overbought and oversold conditions in stock indices price movement.

- Overbought-Oversold levels can be used to provide an early signal for potential indices trend reversals.

- These levels are generated when indicator clusters its tops & bottoms thus setting up the overbought & oversold levels around those values.

However, stock indices trading price might also stay at these overbought & oversold levels & continue heading in that direction for a while & thus it is always good to wait until the BOP crosses over Zero mark.

From the stock indices trading example explained and illustrated below, even though the Balance of Power showed the stock indices price was oversold, stock indices trading price continued moving downwards until the indicator crossed over to above Zero.

Analysis in Stock Indices Trading