Bollinger Bands Indices Technical Analysis & Bollinger Trading Signals

Developed by John Bollinger

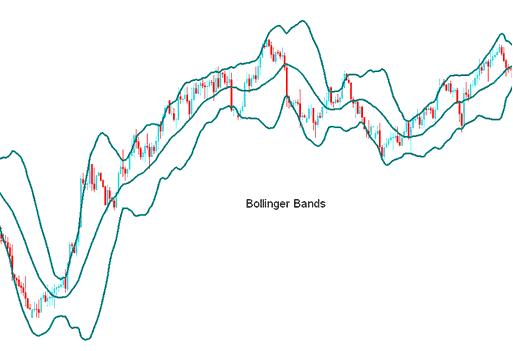

Bollinger bands are formed by 3 lines. The middle line is a Moving Average - 20 period Simple Moving Average.

The bands are then drawn at a distance away from the moving average These are the bands that form the lower and upper lines.

The distance where the bands are drawn is decided by another indicator called the standard deviations. Standard deviation is a measure of volatility in the stock indices trading market or that of indices.

Since the indices market volatility keeps on changing, the standard deviation will keep varying, and since Bollinger bands are drawn using the standard deviation the distance of the bands will keep on adjusting themselves to the stock indices trading market conditions.

When the stock indices trading markets become more volatile, the bands widen and they contract during less volatile periods.

The 3 Bands are designed to encompass the majority of a indices price action. The middle band forms the basis for the trend, typically a 20-periods simple moving average.

This band also serves as the base for the upper and lower bands. Upper band's & lower band's distance from the middle band is determined by volatility. The upper band is drawn at +2 standard deviationss above the middle band while the lower band is drawn at -2 standard deviations below the middle band.

Stock Indices Technical Analysis & How to Generate Signals

- Bands provide a relative definition of high & low

- Used to identify periods of high and low volatility

- Used to identify periods when prices are at extreme zones

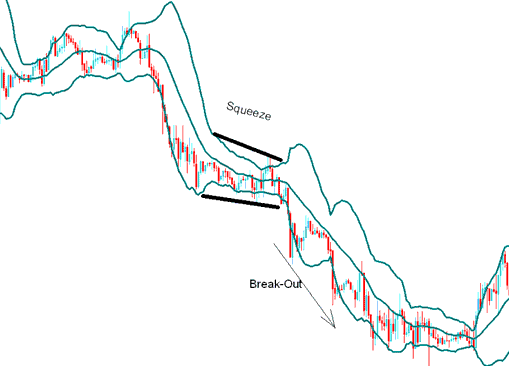

Consolidation

The bands tighten as volatility lessens, this identifies periods of consolidation. Sharp stock indices price break-outs tend to occur after the bands tighten.

Consolidation Pattern

Continuation Signal

If indices prices break through the upper or lower band move outside the bands a continuation of the current indices trend is expected.

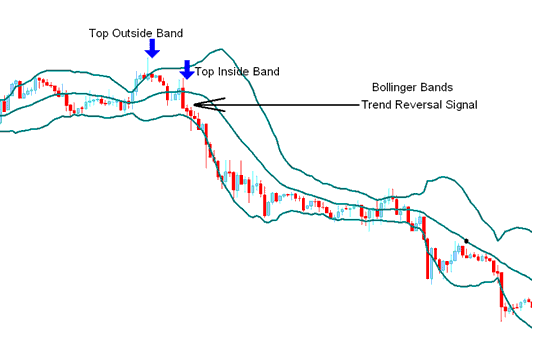

Reversal Trading Signals

Bottoms & tops made outside the bands followed by bottoms & tops made inside the bands call for reversals in the trend

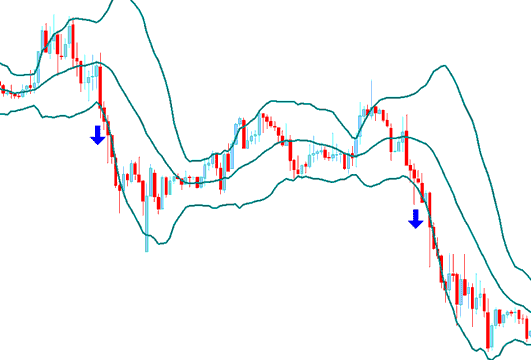

The Head Fake - Stock Indices Trading Whipsaw

Traders should be on the look out for false break outs known as whipsaws or head fakes.

Indices Price often breaks-out in one direction immediately following the Squeeze causing many traders to think the breakout will continue in that direction, only to quickly reverse and make the true, more significant break-out in the opposite direction.

Traders acting quickly on the initial breakout often get caught on the wrong side of the stock indices price action, while those traders expecting a "false breakout" can quickly close out their original position and enter a trade in direction of the reversal. It is always good to combine Bollinger bands with other confirmation Indicators.