Bollinger Band Bulge and Squeeze Analysis

Bollinger Bands adjust on their own. They expand or contract based on price swings.

Standard Deviation is a way to measure how much the price changes in the market, and it's used to figure out how wide or narrow the trading Bollingers are. Standard deviation goes up when market prices change a lot and goes down when prices don't change as much.

- When price volatility is high the Bollinger Band widen.

- When price volatility is low the Bollinger Band narrows.

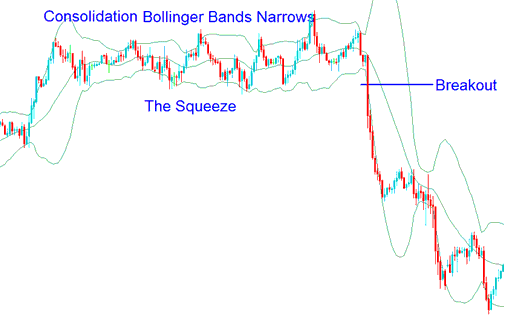

The Bollinger Band Squeeze

A constriction in the Bollinger Bands signals temporary price stabilization, commonly recognized as the Bollinger band squeeze phenomenon.

When the Bollinger Bands demonstrate a tight standard deviation, it typically signifies a period of price consolidation, serving as a signal for a potential price breakout and indicating that traders are readjusting their positions for an upcoming move. Furthermore, the longer the prices linger within the constricted bands' price action formation, the higher the likelihood of a market breakout occurring.

Bollinger Bands Squeeze - How to Trade the Squeeze Pattern of Bollinger Bands.

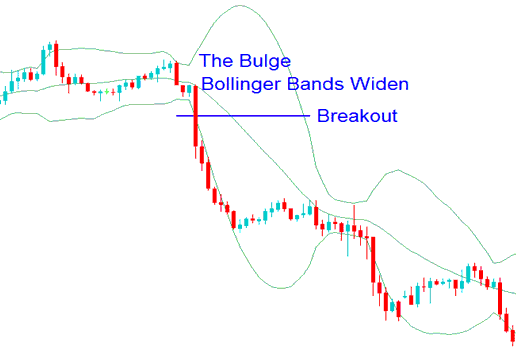

The Bollinger Bulge

An expansion in the width of the Bollinger Bands suggests an impending price breakout event, often termed the Bollinger Bands Bulge.

Wide Bollinger Bands hint at an upcoming trend shift. In the example below, bands spread out from high volatility during a down move. The trend flips when prices hit extremes, based on normal distribution stats. That wide spot forecasts a drop ahead.

Bollinger Bulge - The Bollinger Expansion - Tips for Trading Bollinger Bands Expansion

Explore Additional Lessons & Topics:

- Alligator Index Trade Indicator Analysis

- How to Trade US100 Lesson Guide Strategies List

- SWI20 Trading Indicator MetaTrader 4 Indicators Described

- Developing a Stock Index System: Indicator Based Stock Index Strategy

- How Much Money is 1 Index Nano lot in the Stock Index?

- Index Trends & Index Market Trend Reversal Signal

- MACD Indices Strategies

- Study Index Trade Basics

- Where Do You Get FRA40 in MT4 Platform?

- How to Place Relative Strength Index, RSI Indicator on Index Chart