Bollinger Bands Price Action in Trending Indices Markets

Bollinger Bands spot trends and study them. In trends, it highlights up or down moves.

The Bollinger Bands indicator helps find out where the Indices trend is going. If indices are trending up, the Bollinger Band indicator will clearly show this, heading upward, and the stock trading price will be higher than the middle Bollinger.

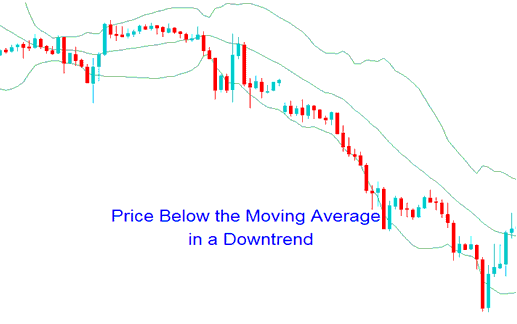

Within a downward trajectory for indices, the price will reside beneath the central band, and the boundaries of the bands will converge downwards.

By scrutinizing the configurations produced and observed within the Bollinger Bands indicator, a market participant can deduce the probable future trajectory of trading activity.

Bollinger Band Patterns & Continuation Signals

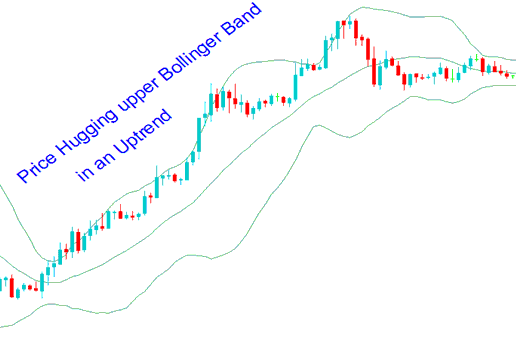

Upwards Trend

- During an upswing, the candlesticks will remain within the upper Bollinger band the central moving average.

- Prices that close above the upper band are a sign of bullish continuation trade signal.

- Prices can hug/ride the upper band during an upwards trend

Upward Indices Trend Trading Method Using Bollinger Band Strategy

Downward Trend

- During a down swing, the candlesticks will stay within the moving average and the lower band.

- Prices that close below the lower band are a sign of bearish continuation trade signal.

- Prices can hug/ride the lower band during an downwards trend

Downward Indices Trend Method Using Bollinger Band Strategy Method

Study More Topics and Guides:

- Want to learn how to trade IBEX35 stock indices? Here's a quick guide.

- Getting Started: How to Trade with Index Software

- How to Interpret Choppiness Index Indicator

- MT4 Meta-Editor: How to Add Index Expert Advisors

- Index Trading Strategies

- Make the most of MetaTrader 4's mobile app - here's how.

- Employing Japanese Candles in Stock Index Analysis

- How to Add Relative Vigor Index, RVI Indicator on Stock Index Chart

- Automating with MQL5: Expert Advisors (EAs) for Index Trading from CodeBase

- What is FTSE100 Chart?