How to Use Pivots Points for Day Trading

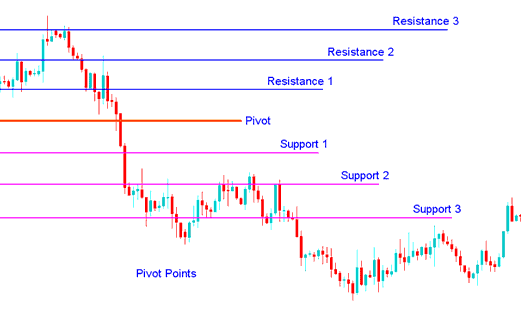

Pivot Points are used by stock indices traders to find support and resistance levels based on the previous day's stock indices price action.

This stock indices indicator is a very useful tool that use the previous bars' highs, lows & closings to project support & resistance levels for future bars.

This stock indices indicator provides an idea of where key support and resistance should be. Place the pivot points on your stock indices charts and stock indices trading price will bounce off one of these levels. These levels are used by stock indices traders to determine market tops, market bottoms or indices trend reversals.

- Daily pivots points are calculated from previous day's high, low, close

This stock indices indicator is shown below

Analysis in Stock Indices Trading

The central pivot itself is the primary level, which is used to determine the trend

The other support & resistance levels are also important in calculating areas that can generate significant market movements.

This stock indices indicator can be used in two ways

The first way is for determining overall Indices trend: if the pivot point is broken in an upward movement, then the stock indices trading market is bullish, and vice versa. However, pivot levels are short-term indices trend indicators, useful for only one day until they need to be recalculated.

The second method is to use these points to enter and exit the stock indices trading markets. This stock indices indicator is a useful tool that can be used to calculate the areas that are likely to cause stock indices price movement.

These points should be used conjunction with other forms of technical analysis such as Moving averages, MACD and stochastic oscillator.

This stock indices indicator can be utilized in many different ways. Here are a few of the most commonly techniques for utilizing them.

Indices Trend Direction: Combined with other technical analysis techniquesmethods such as oversold/overbought oscillators, volatility measurements, the central point might be useful in determining the general trending direction of the market. Trades are only taken in direction of the Indices trend. Buy signal occurs only when the stock indices trading market is above the center pivot point and sell stock indices signal occur only when the stock indices trading market is below the center pivot points.

Indices Price Breakouts: A bullish signal occurs when the stock indices trading market breaks up through the center pivot point or one of the resistances (typically Resistance Zone 1). A bearish signal occurs when the stock indices trading market breaks down through the center point point or one of the supports (typically Support Zone 1).

Indices Trend Reversals:

- A buy stock indices signal forms when the stock indices trading price moves towards a support level, gets very close to this point, touches this point, or moves only slightly through this point, & then reverses and moves back in the opposite direction.

- A sell stock indices signal forms when the stock indices trading price moves towards a resistance level, gets very close to this point, touches this point, or moves only slightly through this point, & then reverses and moves back in the opposite direction.

Stop Loss &/or Limit Profit Values Determined by Support/Resistance: This stock indices indicator might be potentially helpful in determining suitable stoploss &/or limit profit placements. For examples, if trading a long breakout above the Resistance 1 it might be reasonable to position a stoploss.

Combining with Moving Average Cross Over System

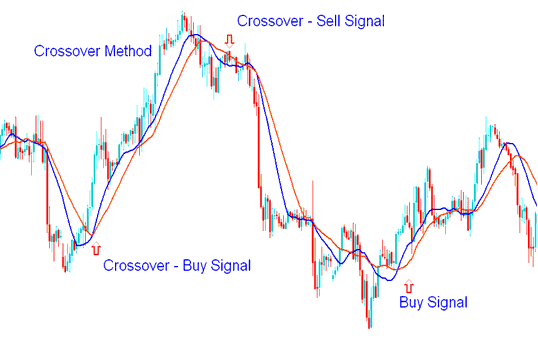

A good indicator to combine and trade reversal indices trading signals is the MA cross-over which can be used to confirm the direction of a reversal indices trade signal.

An investor can then open an order once these 2 indicators give a trading signal in the same direction.

MA Crossover Technique

Moving average crossover method that can be combined with this indicator to come up with a trading system for generating buy and sell stock indices trade signals.

To download Pivot points Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

Once you download the indicator. open it with the MQL4 Language Meta Editor, Then Compile the indicator by pressing the Compile Button and it will be added to your MetaTrader 4.

NB: Once you add it to your Meta Trader 4, the technical indicator has additional lines named Mid-Points, to remove the additional lines open MQL4 Meta Editor(shortcut keyboard key - press F4), & change line 16 from:

Extern bool midpivot = true:

To

Extern bool midpivot = false:

Then Press Compile again, and the indicator will then appear as illustrated on this website.