Reversal Trade Setups

Stock market patterns build after a long rise or fall. The price hits firm resistance on the way up or support on the way down.

Price arrives at a key spot and forms a pattern. They happen a lot, so identification improves with use. Four types stand out.

- Double Tops

- Double Bottom

- Head & shoulders

- Reverse Head & shoulders

This course focuses on double tops and double bottoms. For head and shoulders or reverse head and shoulders, you'll find a separate article that covers those.

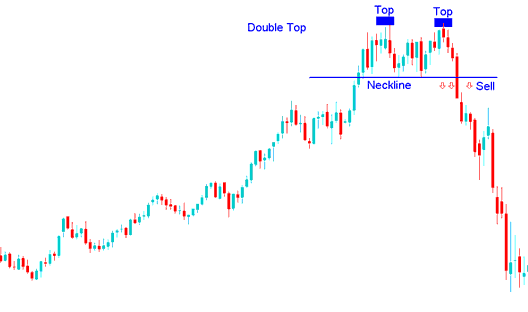

Double Top

This configuration signals a potential reversal following a sustained ascent in asset price. As its name suggests, the formation consists of two successive peaks of nearly identical height, separated by a modest dip.

This pattern wraps up when the price forms a second high and then drops below the low point between those highs. That low point is the neckline. A sell signal triggers when the price breaks under the neckline.

In Indices, this configuration is employed as an initial alert that the upward trend is poised to reverse. Nevertheless, it is solely verified once the neckline is breached and the stocks market moves beneath the neckline. Neck-line is merely an alternative term/designation for the recent support area formed on the trading chart.

Summary:

- Forms after an extended move upward

- This setup formation indicates that there will be a reversal in market

- We sell when price breaks-out below the neck-line: see below for the explanation.

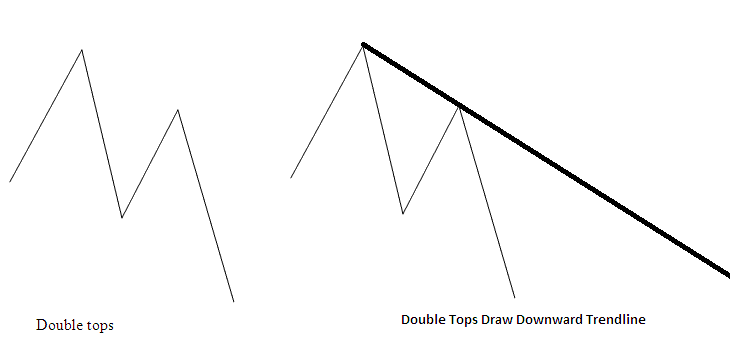

A double top makes an M shape. The top reversal signal comes when the second top is below the first, as pictured. Confirm with a downward trend line like below. Set the sell stop loss just above that line.

M-Shaped

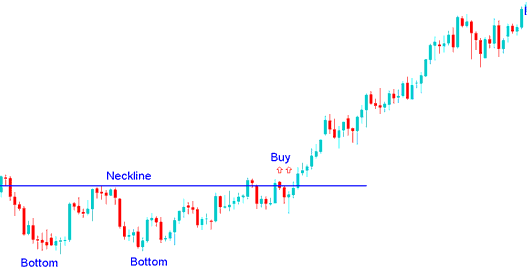

Double Bottoms

Following a long downward trend, this reversal pattern appears. It consists of two troughs that are nearly equal, with a peak in the middle.

This setup is finished when the price makes a second low point and then goes past the highest point between the lows, which is called the neckline. The buy signal from this signal that the market is reaching a bottom happens when the trading market breaks past the neckline going up.

In Indices, this setup formation is a early warning that the bearish trend is about to reverse. It's only considered complete/completed once the neckline is broken. In this formation the neckline is the resistance area for the price. Once this resistance is breached the stock trading market will move upward.

Summary:

- Forms after an extended move downwards

- This pattern reflects that there will be a reversal in market

- We buy when the price breaks out above neckline: see below for an explanation.

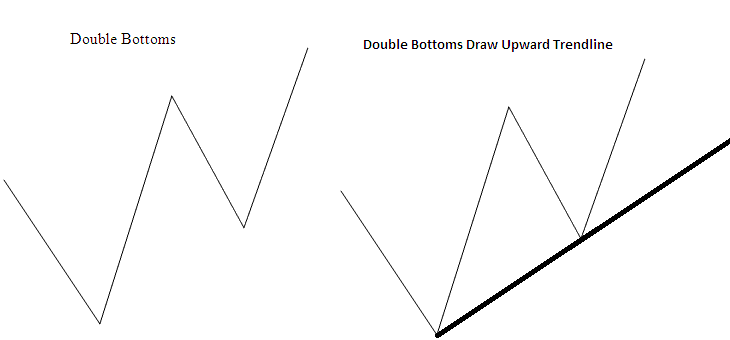

The double bottom pattern forms a W shape. The best reversal stock signal has the second bottom above the first, as shown below. Confirm the reversal by drawing an up trend line like in the picture. For a buy stock signal, place the stop loss order just below this up trend line.

W-Shaped

More How-To Guides and Subjects: