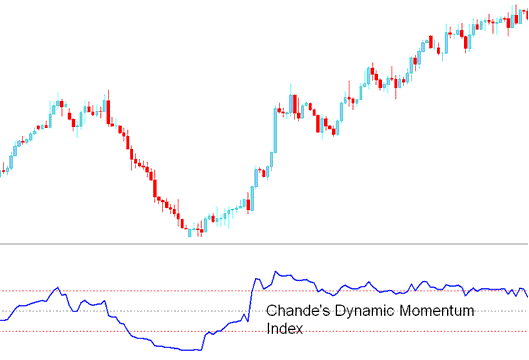

Technical Analysis Using the Chandes Dynamic Momentum Indicator and Chande DMI Trading Signals

Developed by Tushar Chande

Chandes DMI is just like Welles Wilder's RSI, however, there is one very important distinction.

RSI sticks to set price periods. The Chandes Momentum Dynamic Index shifts periods as volatility moves.

This momentum index uses fewer periods as price swings grow. It reacts faster to changes in stock prices.

The Chande DMI is more accurate than the RSI, has less fake outs and is less Choppy

Index Technical Analysis and Generating Signals

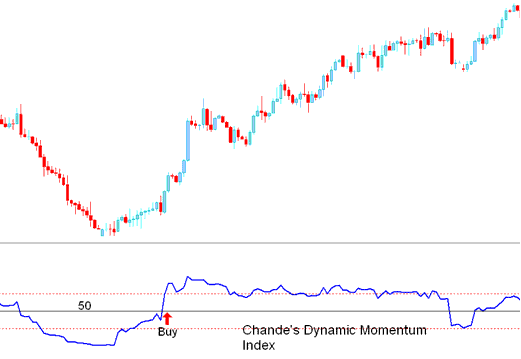

Buy Trading Signal

A buy trade signal is generated when the DMI crosses above 50 level mark.

Buy Signal

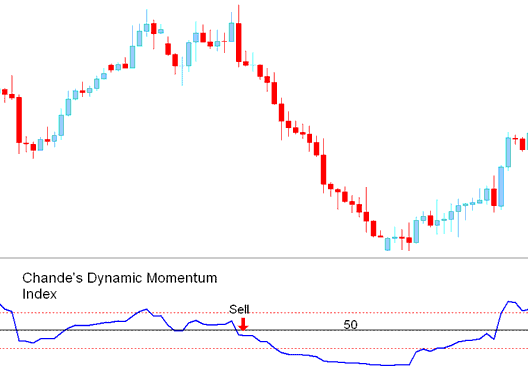

Sell Signal

A sell signal is generated when the DMI crosses below the 50 level mark.

Sell Signal

Learn More Lessons and Tutorials & Guides:

- What is the Indices Trade MetaQuotes Language 5?

- Customizing and Arranging Charts Tool Bars in MetaTrader 4 Trade Platform

- Market Hours for US 30 Index

- Ehlers Laguerre RSI: What the Analysis Shows

- Bollinger Bands Guide: Analyze Band Bulge and Squeeze in Trading Signals

- Learn Stock Index How to Manage Equity Rules Lesson Tutorial

- S&P 500 Opening and Closing Hours

- NETH 25 on MT5 – What It Means and How It Works

- Analysis of the Chaikin Money Flow Index Indicator on Stock Index Charts

- How to Trade the US500 Stock Index: Strategies