Ehler Laguerre RSI Analysis - Technical Overview and Signals for Ehlers RSI Trading

Developed by John Ehler.

Originally used to trade shares and commodities.

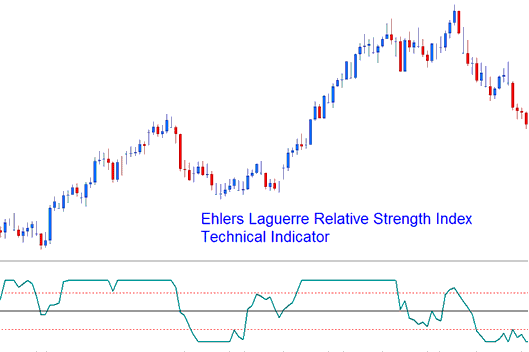

Ehler RSI technical uses a Laguerre filter with 4 parts to cause a "time change," so that slower parts, like price spikes, are delayed more than faster parts. This indicator lets people make smoother filters using only a little bit of data.

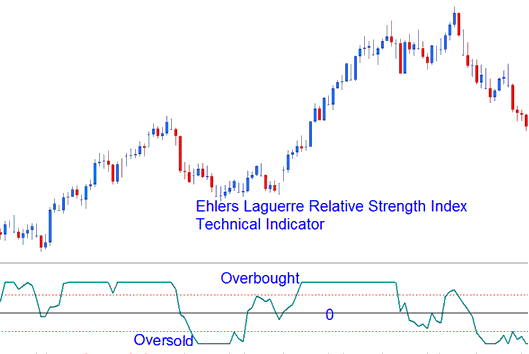

The Ehlers RSI scale runs from 0 to 100. The center line helps create signals. The 80 and 20 levels mark overbought and oversold zones.

The only tweak for this indicator is the damping gamma factor. Set it from 0.5 to 0.85 to fit your trading style.

Ehlers Laguerre Relative Strength Index

Technical Analysis and Generating Signals

This implementation of Laguerre RSI uses a scale of 0 - 100.

Indices Crossover Signals

buy signal- A buy sign is generated when the Ehlers RSI crosses above 50 degree Mark.

A sell signal is triggered when the Ehler RSI drops below the 50-level threshold.

Over-sold/Overbought Levels in Indicator

Over-sold/Overbought Levels in Indicator

A typical use of the Laguerre RSI is to buy after it crosses back above the 20 % level & sell after it crosses back below the 80 % level.

Learn More Lessons:

- Stock Index Chart Analysis Training Guide with Practical Examples

- How to Trade IBEX35 Stock Index

- Where's the SPX index in MetaTrader 4?

- Basics of Indices

- How to trade US100 in the MetaTrader 5 Platform

- How do you trade the SX5E index? Here's a training tutorial.

- A list of examples of how price changes make patterns using candlesticks.