The Engulfing Trader PDF

Bullish Engulfing Candlesticks Pattern in an Downtrend

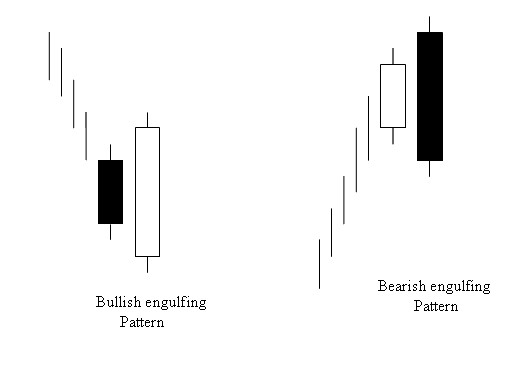

Engulfing Candle Pattern is a reversal candlestick pattern that can be bearish or bullish depending upon whether it appears at the end of a indices down trend or at the end of a upward indices trend.

Bullish Engulfing Stock Indices Candle Pattern - Bearish Engulfing Candle Pattern

Bullish Engulfing Candlesticks Pattern in an Downtrend

Color of the first indices candlestick indicates indices trend of the day.

The second indices candlestick should completely engulf the first indices candle and it should have opposite color.

For Bullish Engulfing the color of the indices candle should be Blue

For Bearish Engulfing the color of the indices candle should be Red

The Engulfing Trader PDF - Bullish Stock Indices Candle Patterns Tutorial - Types of Engulfing Indices Candle Indicator Patterns - Bearish Engulfing Stock Indices Candles Pattern in an Up indices trend - Bullish Engulfing Stock Indices Candles Pattern in an Downtrend

Engulfing Candlesticks Patterns

Morning Star Candle Pattern

Morning Star Candlestick Pattern

Morning Star Candlestick Pattern

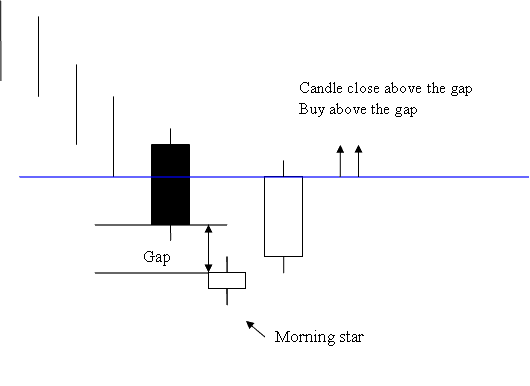

Morning star is a three day bullish reversal stock indices trading candle pattern.

The first day is a long black stock indices trading candlestick.

The second day is a morning star that gaps away from the long black stock indices trading candlestick.

Third day is a long white indices candle which fills the gap.

Filling of the gap & closing of the white indices candle above the gap is a strong bullish indices trade signal.

Traders should open a buy indices trade after market stock indices price closes above the gap formation of the morning star candle pattern. This is the confirmation signal of a buy stock indices signal generated by this stock indices candlesticks pattern.

Evening Star Stock Indices Trading Candle Pattern

Opposite of the morning star

Evening Star Stock Indices Candle Pattern

Evening Star Stock Indices Candle Pattern

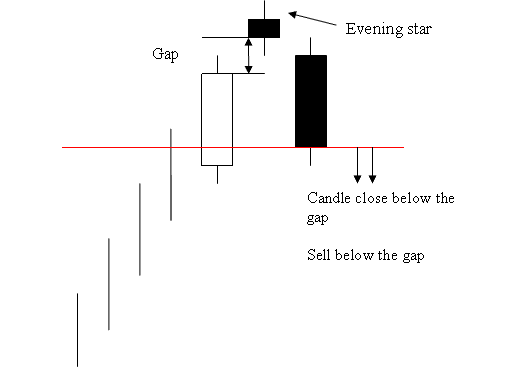

Evening star is a three day bearish reversal stock indices trading candle pattern.

First day is a long white stock indices trading candlestick.

The second day is evening star that gaps away from the long white candlestick.

Third day is a long black indices candle which fills the gap.

Filling of the gap & closing of the black indices candle below the gap is a strong bearish indices trade signal.

Traders should open a sell indices trade once the stock indices trading market closes below gap formation of the evening star. This is the confirmation signal of a sell stock indices signal generated by this stock indices trading candle pattern.