How to Generate Trade Signals with Indices Strategies

Indices Signals MT4 Indices Indicator Strategy

The only method of indices trading is through stock indices trading signals, It is best to learn how to generate these stock indices signals for yourself, this way you do not have to rely on other traders to generate them for you.

Generating indices trading signals is not easy & requires you to have a lot of stock indices technical analysis knowledge and experience, but the earlier you start practicing how to generate these stock indices signals for yourself the better it is for you.

A good method of how to practice generating indices trading signals with indices trading systems is to open a free practice Indices demo stock indices trading account and test your trading signals on this practice account risk free without risking your money, then once you have tested your indices strategies & they are profitable on the demo practice account you can the use these indices trading signals on a live stock indices account.

The technique of how to practice generating these stock indices signals as well as how to back test the indices trading signals on the demo indices account using MetaTrader 4 platform is discussed below:

So, How Can a Trader Generate Indices Trade Signals?

The best strategy of generating indices trading signals is through indices trading systems, You can Learn how to come up with indices systems from the lesson how to create Trading Systems on the right navigation menu under the topics Key Concepts.

A stock indices system is a combination of one or two or more technical indicators with written trading guide-lines of how these indicators will generate these stock indices trade signals.

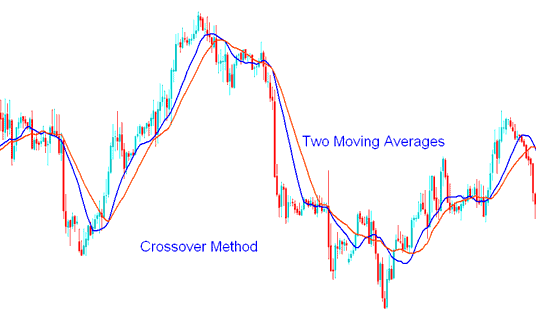

Take an example of the simplest trading system or strategy known as MA cross-over method. A buy stock indices signal or sell stock indices signal is generated when there is a crossover of the 2 moving averages: either a buy stock indices signal for an upward MA cross-over or a sell stock indices signal for downward trend.

Stock Indices MetaTrader 4 Signal Indicator - Indices Trade Signals MetaTrader 4 Indicator Strategy Moving Average Crossover Strategy

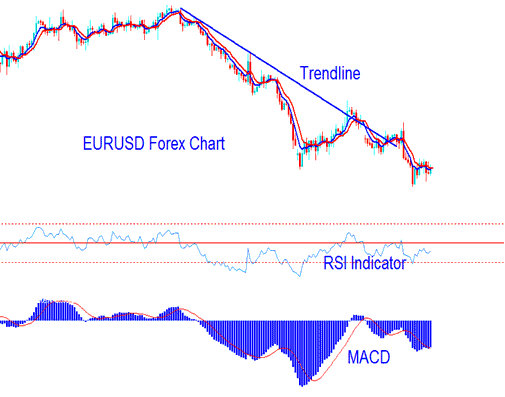

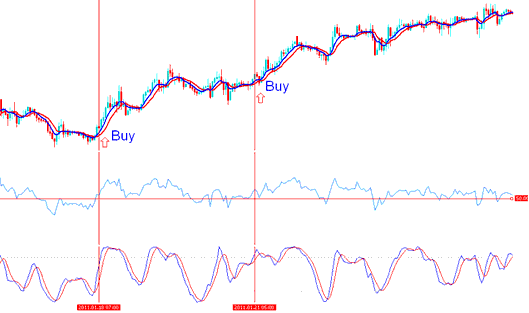

The trading system example explained and illustrated below shows a indices trading system using the above moving average strategy combined with the RSI and MACD indicators to generate buy and sell stock indices trades.

Example of Generating Stock Indices MetaTrader 4 Free Signals - Indices Trade Signals MetaTrader 4 Indicator Strategy

Example of Generating Stock Indices MetaTrader 4 Free Signals - Indices Trade Signals MetaTrader 4 Indicator Strategy

When it comes to generating buy and sell stock indices trading signals, stock indices traders should use simple indices systems to generate these stock indices trade signals.

Stock Indices MetaTrader 4 Signal Indicator - Indices Trade Signals MetaTrader 4 Indicator Strategy - Buy & Sell Trading Signals

Indices Signals MT4 Indices Indicator Strategy

An example of a simple indices system that works, is one that's a combination of:

- Moving average crossover strategy

- RSI

- MACD

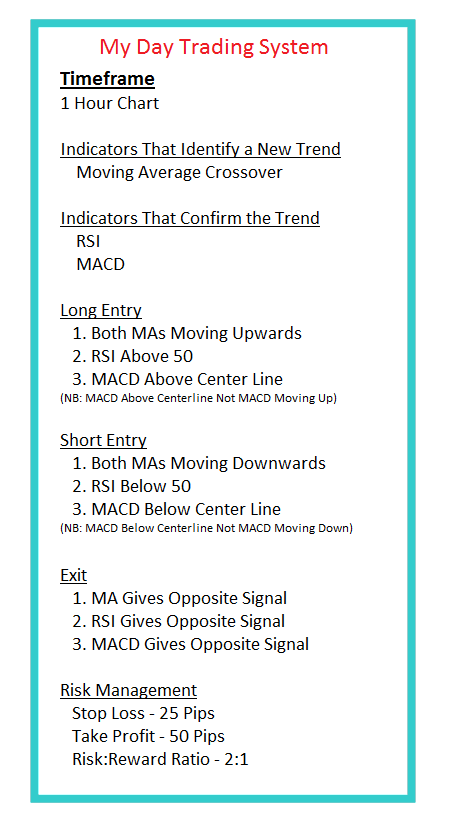

The written indices trading rules are:

Generating Indices Trading Signals Strategy - Indices Trading System Examples

Indices Trade Rules:

Buy Indices Trade Signal is Generated when:

- Both Moving averages going up

- RSI value above 50

- MACD above centerline

Sell Indices Trade Signal is Generated when:

- Both Moving averages going down

- RSI value below 50

- MACD below center-line

Generating Buy and Sell Indices Trades - Examples of a Method

Exit Trade Signal

Exit signal is generated when MA, RSI & MACD indicator give a signal in opposite direction.

The chart timeframe to use is 1 hour chart timeframe or 15 minutes chart timeframe depending on what type of trader you are.

For a beginner trader the above written trading rules will give good buy and sell indices signals, the only thing that a trader needs to do is to have the discipline to follow the written indices trading signals rules the exact way they are, and wait for a buy or sell trade transaction to be indicated by your indices strategy & trade after the signals have been generated, not before they are generated.

Back Testing

Generating Trading Signals with a trading system is one of the easiest method to trade indices, it is the best way that a beginner can attempt to determine the direction of the market indices trend with a good level of accuracy, and with a little back testing on practice trading account so as to gradually increase the level of accuracy of this indices trading signals strategy

The best way to back test a indices strategy is by following these two steps:

- Paper Trade

- Stock Indices Demo Trade

Indices Paper Trading - This method of testing a trading system involves placing your system on the stock indices charts, then take the chart back to a particular date, 3 months back for example, and then using this chart history to determine where your indices trading strategy would have given buy, sell and exit trading signals. Write down these points and the profit per trade transaction on a piece of paper and then calculate the total profit after you have recorded a good number of stock indices trades such as 50 paper trades indices trading transactions and determine if your trading method is overall profitable, the win ratio, the loss ratio and the risk:reward.

This is an ancient strategy of testing indices trading systems which was used by traditional traders when there was no online stock indices markets or computers for that matter, the trader would use something like the A3 or A2 paper, graph format paper and draw the charts manually (Imagine plotting the charts on your indices trading platform by hand every day or every hour, would you be ready to do that? I doubt) Those investors were hardworking than most, some were so used that they still continue to paper trade the online stock indices market & draw the indices charts on paper, anyway for our paper technique example, just a sample data of 50 trade transactions is all we need.

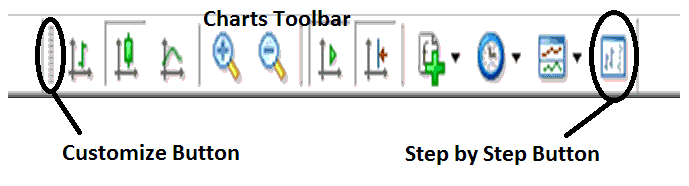

A good indices tool to use to back-test your stock indices trading system is known as the MT4 Indices Step by Step Tool. Found on Meta Trader 4 charts toolbar of MT4 platform, If you want to find the charts toolbar on the MetaTrader 4 platform it is at the top of the MetaTrader 4 platform. If it is not: Click View (next to file, top-left corner of MetaTrader 4)>>> Tool Bar >>> Charts. Then click Customize button key >>> Select Indices Step by Step >>> Click Insert >>> Close.

Meta Trader 4 Indices Platform Chart ToolBars - How to Trade Indices for New Traders

Indices Trading Step by Step Button for Back Testing Indices Systems Discussed

Once you get this Meta Trader 4 tool you can move your stock indices chart backwards, & use this Meta Trader 4 tool to move the charts indices trading step by step while at the same time testing when your indices trading system would have generated either a buy or sell trade transaction, and where you would have exited the trade, then write down the amount of profit/loss per indices trade transaction & out of a sample number of indices trading transactions you would then calculate the overall profits/losses generated by the trading strategy.

If your indices strategy is profitable on paper then, it's time to demo indices trade and testing if the it is profitable on real market as it is on paper method. This is the process of testing or back-testing a system.

Writing a Indices Trading Journal

Maintain a Indices Journal to keep track of profitable indices trades, and determine why these trades were profitable. And also keep a log of all losing trades, determine why these trades made a loss and the avoid making these same mistakes the next time you trade using your strategy.

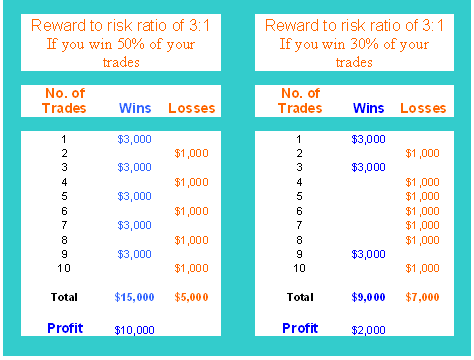

Tweak your indices system until you get a good risk:reward ratio, with indices trading signals that you generate. Aim for a good risk: reward of 3:1 and a win ratio of above 70% is a good ratio, with good indices trading money management even a indices trading strategy with a win ratio of even 30% i.e. Less than half of your indices trading transactions make profit you can still make a profit. You might want to read this topic to know what the table below is all about: Risk : Reward Ratio.

Risk to Reward Ratio Chart of Indices Money Management Strategy - Indices Trade Strategies Methods Explained

Read Indices Money Management Strategies Methods Tutorial Guide

A manual indices trading system is still the best way to generate indices trading signals compared to automated trading systems, a manual indices trading strategy is a better technique and is also much simpler to implement.

However, other traders prefer automated indices systems & for those then they can check the information on this page MQL5 Indices EAs and automated indices trading systems.

You can also view our extensive list of indices strategies topics that provides you with various methods of buy and sell analysis using a number of diverse technical methods, navigate to the Indices Strategies Section.