Reversal Setups: Head and Shoulders and Reverse Head Shoulders

Head & shoulders Pattern

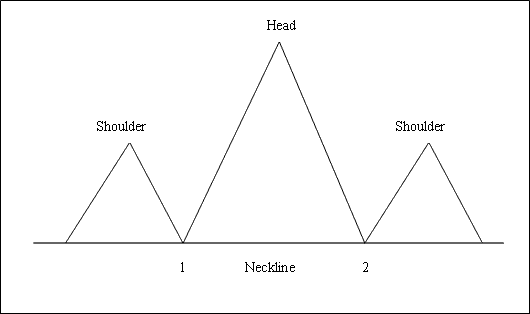

This pattern in stock charts indicates a reversal, emerging after a prolonged upward movement. It consists of three successive peaks known as the left shoulder, the head, and the right shoulder, with two moderate low points situated between these shoulders.

The head and shoulders pattern finishes when price drops below the neckline. Connect the two troughs between shoulders to draw it.

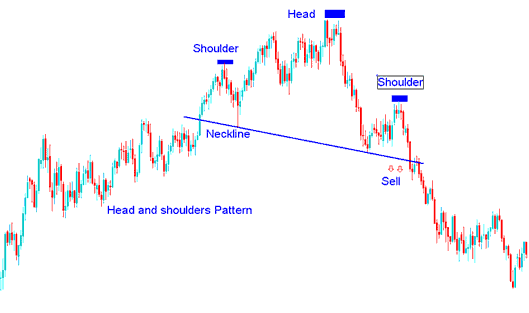

To go short, traders set their sell stop orders just below the neck-line.

Summary:

- This setup forms after an extended move upwards

- This formation indicates that there'll be a reversal in the stock trading market

- This setup resembles head with shoulders thus its name.

- To draw the neck-line we use point 1 & point 2 such as shown below. We also extend the line in both directions.

- We sell when stock price breaks out below the neck-line point: see the trading chart below for an explanation.

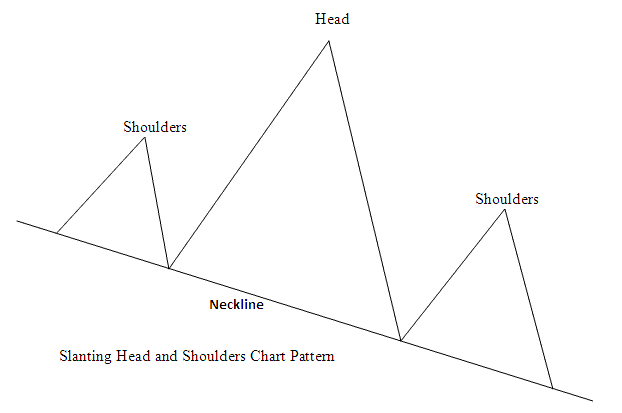

Head and shoulders can tilt on a sloped neckline. The stock example below shows how.

Example of Head and Shoulder Chart Setup on a Trade Chart

Head and Shoulders Chart Setup

This pattern in stock charts can also happen on a neck line that slopes: like the one shown, the neck-line does not have to be flat.

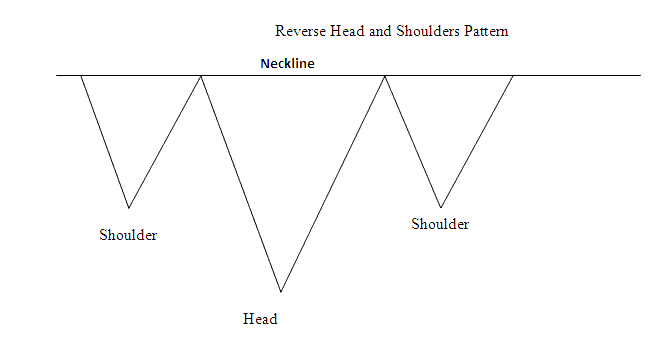

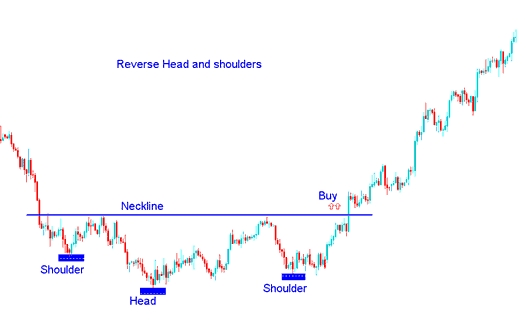

Reverse Head and Shoulders Chart Setup

This chart configuration represents a classic reversal pattern known as the Head and Shoulders, typically surfacing after a prolonged downtrend. Visually, it resembles an inverted head and shoulders structure.

This pattern setup is considered complete once stock price penetrates above neck-line, which's drawn by connecting these 2 peaks in between the reverse shoulders pattern.

To go long buyers/bulls set their buy stop pending orders just above neck-line.

Summary:

- This pattern setup forms after an extended move downward

- This pattern indicates that there'll be a reversal in the stocks trading market

- This setup formation resembles up-side down, thenceforth the name Reverse.

- We buy when stock price breaks above the neck-line point: see the trading chart below for an explanation.

Example of Reverse Head & Shoulders Chart Setup on a Trade Chart

Example of Reverse Head Shoulders Chart Setup

Get More Tutorials & Courses:

- NKY225 Pips Calculation – Figuring Out Pips for NKY225 Stocks

- How to Place DJI30 in MetaTrader 4 iPhone Trade App

- FX Brokers That Provide Nas100 Stock Index

- How Do You Analyze Trade MT5 Course Tutorial Software Tutorial?

- How to Place DJI30 in MetaTrader 4 Mobile Trade App

- Location and Accessing the Index History Center Feature on the MetaTrader 4 Software Tools Menu.

- Learn Stock Index How to Manage Equity Rules Lesson Tutorial

- Insert Menu Options in MetaTrader 4 Trade Software Explained

- How Do I Interpret Trade MetaTrader 5 Course Tutorial Software Guide?

- How to Add Money Flow Index Indicator in Trading Chart in MetaTrader 4 Software Platform