Technical Analysis of Double Bottoms Setups

How to Analyze Double Bottoms Setups

To learn and know how to interpret the market using double bottoms stock chart patterns a indices trader should first of all learn the technical analysis of double bottoms stock chart pattern explained in this tutorial.

Double Bottoms Pattern

The double bottom formation represents a reversal pattern observed in index markets that materializes after a prolonged decline.

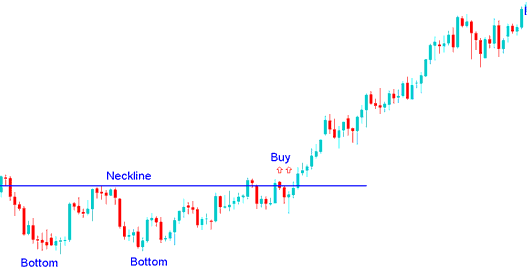

The double bottoms chart pattern is made of 2 dips that are about the same, with a small peak in between the 2 dips on the chart.

The Double Bottoms pattern on a stock chart is confirmed complete only after the stock price achieves the second low point and subsequently breaks above the highest price reached between those two lows, known as the neckline.

The buy signal from this double bottom, which means the market has hit its lowest point, happens when the market goes above the neck-line.

Within the Indices market, the Double Bottom pattern serves as an early warning sign indicating that a prevailing downtrend is poised for a shift.

A Double Bottoms Setup is confirmed only after the neckline is breached. In such chart patterns, the neckline represents the resistance level. Once this resistance is broken, the market is expected to move upward.

Summary:

- Double bottom stock chart pattern forms after an extended move downwards - indices downwards trend

- This Double bottoms stock chart pattern formation shows that there'll be a reversal in stock market

- We buy when stock price breaks out above neck-line: as elaborated on the illustration illustrated and shown below.

Technical Analysis of Double Bottom Patterns?

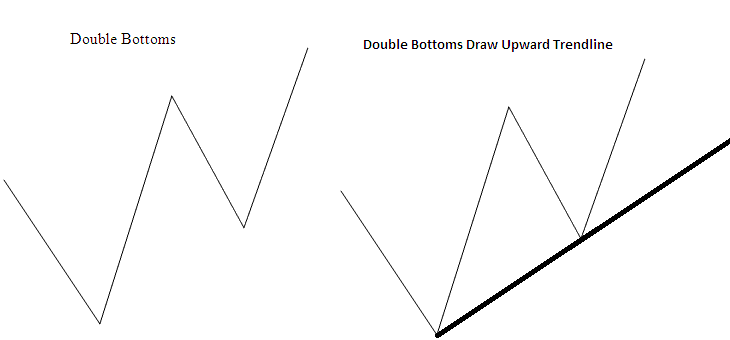

The double bottom indices pattern setup look like a W-Shape stock chart pattern, the best reversal signal is where second bottom is higher than the first bottom like as illustrated below.

This means the reversal indices signal from the double bottom stock chart pattern can be confirmed by drawing an upward trend line just as is illustrated and shown below. If a indices trader opens a buy trade signal the stoploss order will be placed just below this upwards trend-line.

How Can I Analyze Double Bottoms Setups

Learn More Courses & Tutorials:

- How Can I Add SPX500 in MT5 iPhone App?

- US500 in MetaTrader 4: What You Need to Know

- Looking to add US100 in the MetaTrader 5 app on Android? I'll help you set it up.

- Calculation of the Margin Requirement for a Full Lot of the Wall Street 30 Index

- Learning Stock Index Concepts

- Stock Index Indicators – What Every Trader Should Know

- Trying to get DJ30 in your MT4 app? I'll explain how.