Fibonacci Expansion Strategies in Indices Trading

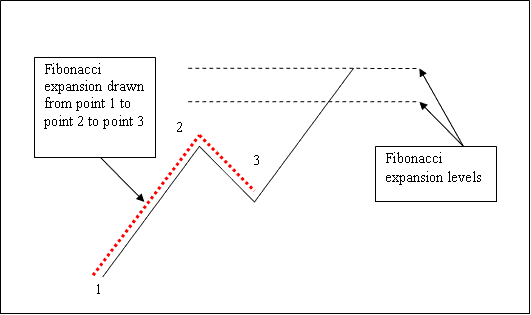

Fibo expansion is drawn using 3 chart points.

To draw Fib Expansion zones we wait until the stock indices price retracement is complete & the stock indices price starts to move in original direction of the Indices trend. Where the retracement reaches is used as chart point 3.

The Fibonacci expansion example explained and illustrated below shows the 3 Chart Points where the Fibonacci expansion indicator is drawn, marked as Chart point 1, 2 and 3. Chart point 1 is where the indices trend started, Chart point 2 is where the indices trend pulled back and retraced and Chart point 3 is where the stock indices retracement reached as displayed on the Fibonacci Expansion Tool example described & illustrated below.

Fibo Expansion Strategy using Fibonacci Expansion Areas

Please note where these Fibonacci Expansion levels are drawn - Fib Expansion levels are drawn above the Fibonacci Technical Indicator, these are points where the trader will set the takeprofit orders using these Fibonacci Expansions - 61.80% and 100% Fibo Expansion Areas.

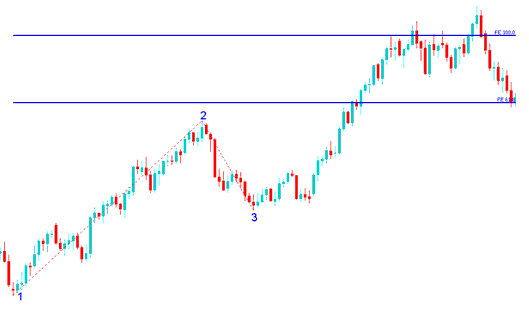

Drawing Fib Expansion Levels on an Upwards Indices Trend

We use Fibo expansion areas to estimate where the market trend movement will reach. There are Two important Fibo expansion areas: 61.8% & 100% Fibo Expansion Areas, these are used for taking profit.

On the Fibo expansion examples explained below you can see that the Fib expansion indicator is plotted along the direction of the trend, since the trend is upward - the Fibonacci expansion is drawn upward.

These Fibo expansion levels are displayed as horizontal lines above Fibonacci Expansion indicator, showing profit taking areas. In the stock indices trading example explained and illustrated below if you had used of 100% Fibonacci expansion you would have made nice profit from the trade set-up.

Drawing Fibonacci Expansions on an Upwards Indices Trend - Fibonacci Expansion Strategies in Indices Trading

From the above Fibonacci expansion examples, the upward trend continued and both 61.8 % and 100.0% Fibonacci expansion levels were all hit after which stock indices price retraced again after getting to the 100.0 percent Fibonacci Expansion zone.

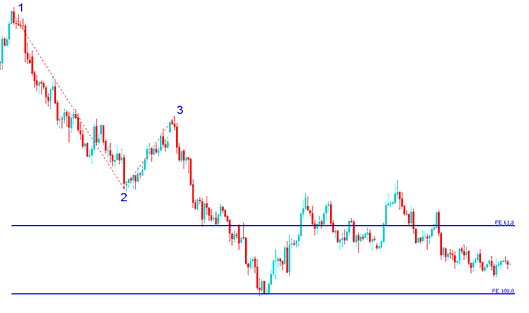

Drawing Fib Expansion Areas on a Downwards Indices Trend

Since we use this Fibonacci expansion tool to estimate take profit levels, how do we draw it in a downwards Indices trend?

We draw the Fibonacci expansion indicator tool from chart point 1 to two to Three as shown below. Remember we always draw this Fibo expansion tool in direction of the trend. In the Fibonacci expansion example explained and illustrated below, can you figure what direction we have drawn it? That is right - downward direction.

Try and identify the difference between how we have drawn Fibonacci expansion above and how Fib Expansion is drawn below. This time you would also have used Fib expansion zone 100%, just where the stock indices price reached as illustrated on the stock indices trading examples explained below. That would have been a nice take profit area.

Fibonacci Expansion Strategies in Indices Trading

From Fibonacci expansion examples above, after plotting this Fib expansion tool there are two levels which are used to show the profit taking areas, these 2 Fibo expansion levels are drawn as horizontal lines across the stock indices price chart.