Ichimoku Indicator

Ichimoku came from a Japanese chart method. A newspaper writer with the name Ichimoku Sanjin developed it.

- Ichimoku means: 'a glance' or 'a look'

- Kinko meaning 'equilibrium' or 'balance'

- Hyo is the Japanese word/term for "chart"

Therefore, Ichimoku translates to ‘a glance at an equilibrium chart'. The Ichimoku technique aims to ascertain the probable market direction and assists traders in determining the ideal timing for entering or exiting market positions.

Calculation

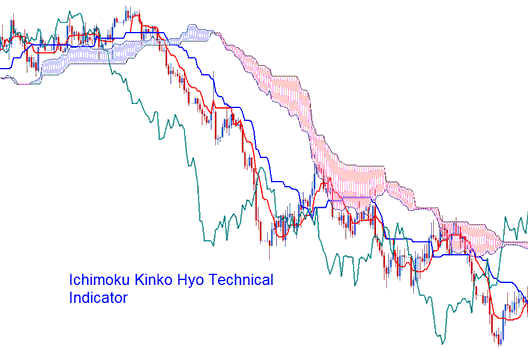

This signal shows five lines, and they are made using the center points between earlier highest and lowest prices. The five lines have the following calculations:

1) Conversion Line (Tenkan-Sen): Represented by the Red Line, calculated as (Maximum High + Minimum Low) / 2 over the preceding 9 price periods.

2) Kijun-Sen (Base Line): Depicted in Blue. Calculation: (Highest High + Lowest Low) / 2, over the preceding 26 price bar periods.

3) Chikou Span: Lagging Span: Green Colored Line Today's closing price drawn 26 price periods behind

4) Senkou Span A: Leading Span A is calculated as (Tenkan Sen + Kijun Sen) / 2, plotted 26 price bar periods into the future.

Senkou Span-B (Leading Span B) is calculated as (Highest High + Lowest Low)/2 over the past 52 periods, plotted 26 periods ahead.

Kumo: Cloud: area between Senkou Span A and B

Technical Analysis and Generating Trade Signals

Bullish trading signal - Tenkan-Sen crosses the Kijun-Sen from below.

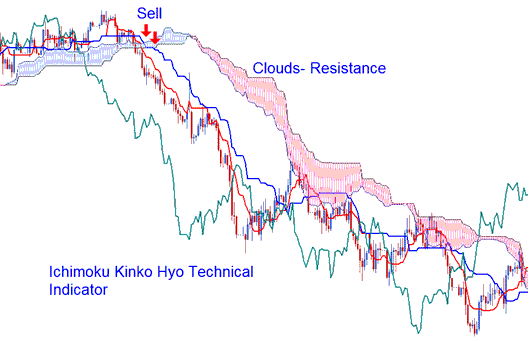

Bearish trading signal - Tenkan-Sen crosses Kijun-Sen from above.

Nevertheless, the buy and sell signals generated by this stock tool exhibit varying levels of inherent strength across different price zones.

Technical Analysis in Indices Trade

Bullish cross-over signal forms above the Kumo (clouds),

Strong buy signal.

Bearish cross-over signal forms below Kumo (clouds),

Strong sell signal.

If a bullish or bearish signal happens inside the Kumo (clouds), it is seen as a medium-strength signal to buy or sell on the market.

A bearish crossover above the clouds is seen as a weak sell signal, while a bullish crossover below the clouds is seen as a weak purchase signal.

Support & Resistance Zones

Areas of support and resistance can be anticipated based on the existence of Kumo (clouds). Additionally, the Kumo can help determine the prevailing market trend.

- If price is above the Kumo, current trend is said to be upward.

- If the price is below the Kumo, current market trend is said to be downward.

The Chikou Span, also known as the Lagging Span, is utilized to assess the underlying underlying strength supporting the buy or sell indication.

- If the Chikou Span indicator is below the closing price of the last 26 periods ago and a sell short signal is given/generated, then the strength of the market trend is downward, otherwise the signal is considered to be a weak sell signal.

- If there is a bullish signal & the Chikou Span is above price of the last 26 periods ago, then the strength of the market trend is to the up-side, otherwise it's considered to be a weak buy signal.

More Tutorials and Topics:

- How to Trade SPAIN35 on the MT5 Platform

- How to Trade Fibonacci Pullback Indices on MetaTrader 5

- How do you look at downward trend-lines for indices in MetaTrader 4 Software?

- What's inside the MetaTrader 5 interface? A quick intro.

- MetaTrader 4 Panel for Index Terminal Window

- Strategies for Stock Indices

- Analysis of TSI Index Indicator

- RSI Shows When Prices are Likely to Rise & Indices Show When Prices are Likely to Fall

- Index Info

- How to Add a Stock Index Order on MetaTrader 5 Mobile Indices App