Divergence Tutorial

RSI indicator is one of the oftenly used divergence technical indicator. This stock indices indicator is an oscillator similar to the RSI and it can be used to trade divergence setups just the same way as the RSI indicator.

RSI Stock Indices Technical Analysis & RSI Trading Signals

RSI Divergence Technical Indicator

RSI Bullish Stock Indices Trading Divergence Setups

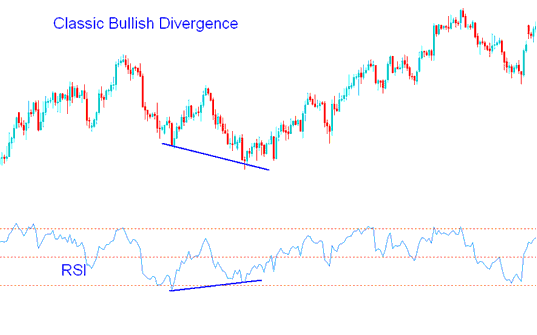

Classic RSI Bullish Indices Trading Divergence Setup

RSI classic bullish divergence occurs when stock indices price is forming lower lows ( LL ), but the RSI indicator is making higher lows (HL).

RSI Divergence Guide

RSI classic bullish divergence warns of a possible change in the indices trend from down to up. This is because even though the stock indices trading price went lower the volume of sellers that pushed the stock indices price lower was less as shown by the RSI technical trading indicator. This is an technical indicator of the underlying weakness of the downwards trend.

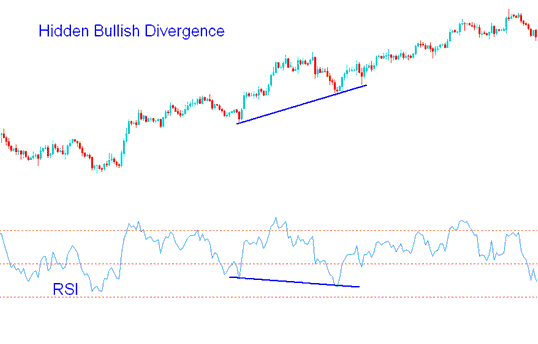

Hidden RSI Bullish Stock Indices Trading Divergence Setup

Forms when stock indices price is forming a higher low ( HL ), but the RSI indicator is showing a lower low (LL).

RSI hidden bullish divergence occurs when there is a retracement in an upwards indices trend.

Indices Trading Hidden Bullish Divergence - RSI Divergence Guide

This setup confirms that a retracement move is complete. This RSI divergence setup indicates underlying strength of an upward indices trend.

RSI Bearish Indices Trading Divergence

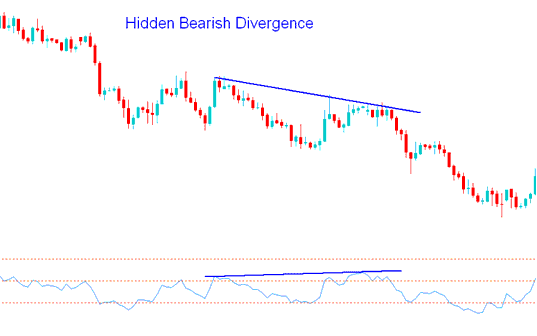

Hidden RSI Bearish Stock Indices Trading Divergence Setup

Forms when stock indices price is forming a lower high ( LH ), but the oscillator indicator is showing a higher high (HH).

Hidden bearish divergence occurs when there is a retracement in a downwards trend.

Indices Hidden Bearish Divergence - RSI Divergence Guide

This setup confirms that a retracement move is complete. This divergence indicates underlying strength of a downwards indices trend.

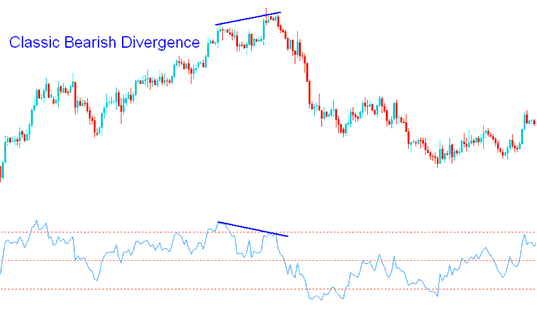

RSI Classic bearish Indices Trading Divergence Setup

RSI classic bearish divergence occurs when stock indices price is showing a higher high ( HH ), but the RSI technical indicator is lower high (LH).

Indices Trading Classic Bearish Divergence - RSI Divergence Guide

RSI Classic bearish divergence warns of a possible change in indices trend from up to down. This is because even though the stock indices price went higher the volume of buyers that pushed the stock indices price higher was less as shown by the RSI technical trading indicator. This is an technical indicator of the underlying weakness of the upwards trend.