Index Divergence Example

Divergence trading has two setups and these are bullish & bearish divergence setups. For each of these setups there is also classic divergence & hidden divergence, these trading setups are explained below.

RSI is one of the commonly and often used divergence indicator. This technical indicator is an oscillator trading similar to the RSI & it can be used to trade divergence setups just the same way as the RSI indicator.

RSI Divergence Example

RSI Indicator Divergence Example

RSI Bullish Divergence Example

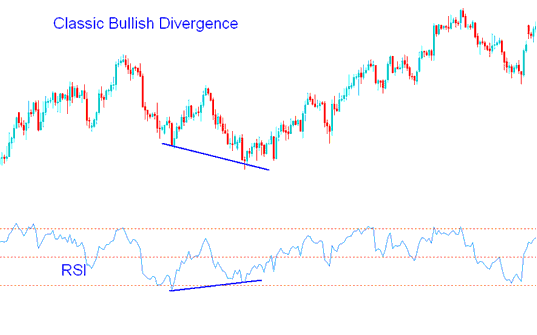

Classic RSI Bullish Index Divergence Trading Setup

RSI classic bullish divergence occurs when stock price is making/forming lower lows (LL), but the RSI is forming/making higher lows (HL).

RSI Divergence Examples

RSI classic bullish divergence trade setup warns of a possible change in the trend from downwards to upward. This is because even though price moved & headed higher lower the volume of sellers who moved price lower was less just as illustrated & displayed by RSI. This is a technical indicator of the underlying weakness of the downward trend.

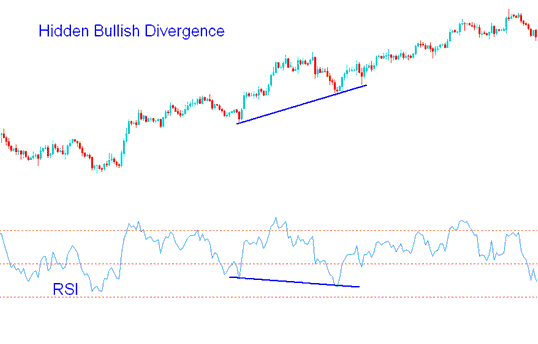

Hidden RSI Bullish Indices Divergence Trading Setup

Forms when stock price is making/forming a higher low (HL), but the RSI is showing a lower low (LL).

RSI hidden bullish divergence occurs when there is a retracement in an up-wards trend.

Index Hidden Bullish Divergence - RSI Divergence Examples

This divergence illustration setup confirms that a market retracement move is complete. This RSI divergence trade setup shows underlying power of an upwards trend.

RSI Bearish Divergence Example

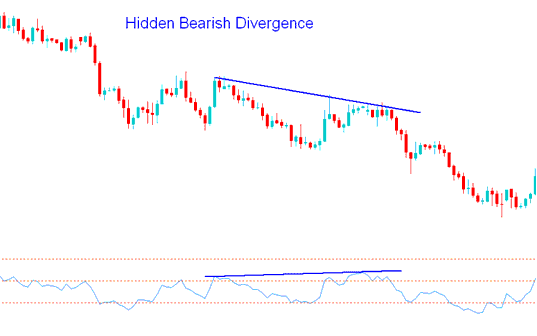

Hidden RSI Bearish Stock Divergence Trading Setup

Forms when stocks price is forming/making a lower high ( LH ), but oscillator indicator is showing a higher high ( HH ).

Hidden bearish divergence set-up forms when there's a retracement in a down-wards trend.

Index Hidden Bearish Divergence - RSI Divergence Examples

This divergence setup illustration setup confirms that a market retracement move is exhausted. This divergence indicates underlying strength of a downwards trend.

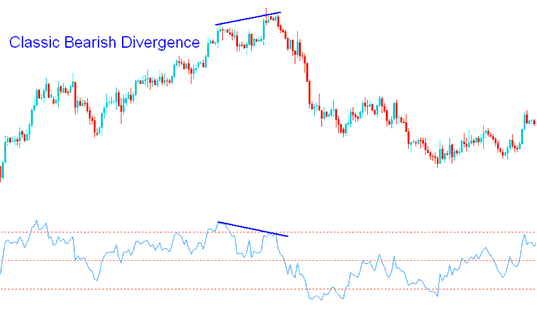

RSI Classic bearish Index Divergence Trade Setup

RSI classic bearish divergence occurs when stock price is forming/making a higher high (HH), but the RSI technical indicator is lower high (LH).

Index Classic Bearish Divergence - RSI Divergence Examples

RSI Classic bearish divergence signals a possible shift in trend from upward to downward. This is because even though price moved & headed higher higher the volume of buyers(bulls) that moved price higher was less like as illustrated and shown by the RSI technical indicator. This is a technical indicator of the underlying weakness of the upwards trend.

Get More Lessons and Tutorials and Courses:

- MA Envelope Index Indicator Analysis

- How to Open Live Account on MT4 Software Platform

- How to Analyze Trading Trend Reversal on Trading Charts

- How Can I Find DJ30 Index in MT4 App?

- Index Bollinger Band Indicator

- How Do You Download Expert Advisor Bots in MetaTrader 4 Trade Platform?

- How to Use Help Button Menu in MT4 Software Platform