Example Templates

When creating your own indices system, there are a few things to keep in mind. Your indices strategy needs to be able to identify new Indices market trends, while at the same time making sure you do not to get faked out/whipsaws. The real trick is, once you've created a indices trading system that works for you, stick to it. Being disciplined will help you a lot in becoming successful in stock indices trading.

Before trading Indices on a live indices trading account, you've to figure out what trading strategy works for you. It's good to know in what chart timeframe you are going to be working in, & how much you're willing to risk once you start indices trading online. All these factors should be factored in, and should be written down within your indices trading plan. A good place to test this indices trading plan would be on a free demo trading account. This is where you test your strategies risk free without investing money to determine which strategy is best suited for you.

So, now how can a trader like you create a "good indices trading system" or the "best indices trading system"?

To come up with a good trading strategy the first thing to do is to define your objective or goal:

The following examples illustrates a goal and explains the rules of how to achieve that goal

Stock Indices Trading Goals

1.Identify a new indices trend

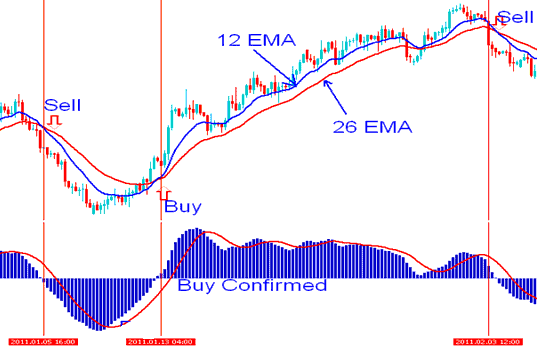

Moving average crossover method indices trading strategy is most oftenly used strategy to identify a new indices trend. Time to open a long or short trade is determined when 2 moving averages indicators cross over or cross under each other.

2.Confirm the new indices trend

Relative Strength Index(RSI) Indicator and Stochastic Oscillator Indicator are the most commonly used technical indicators to confirm a Indices trend.

Indicator based Trading System

The best type of a indices trading method is one that is indicator-based. You will find it straight forward to generate the stock indices signals & thus less error-prone on your part & this will help you to avoid market whipsaws.

There are several things we want to achieve when creating a Stock Indices trading system:

- Find entry points as early as possible.

- Find exit points securing maximum gains.

- Avoid fake entry & exit signals.

- Proper Indices Money Management Guidelines

Finishing these four goals will result in a profitable indices strategy that works.

The last piece of information needed, is deciding how aggressive you are going to be when entering & exiting a trade. Those traders who are more aggressive wouldn't wait until the stock indices chart candle stick closes and would enter as soon as their technical indicators match up. But most traders would wait until the stock indices chart candlestick of the chart time frame they are using has closed, to have more stability when entering a the stock indices trading market.

To get profits out of the stock indices trading market you need to build your own profitable trading system: a trading technique that will generate profitable stock indices signals. You need to have your own strategy that will help you achieve your financial goals. Sometimes the best trading systems are the ones that you build on your own. No need to keep searching online for best indices trading systems or for indices trading systems which work, this web site provides you with all the indices trading tools required to help you and guide you on how to create your own indices trading systems.

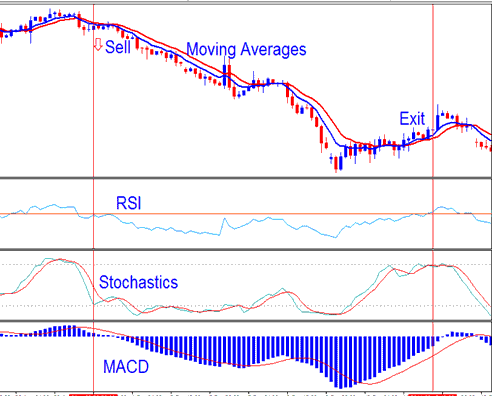

Shown Below is an example of a Indices trade system based on RSI, MACD & Stochastic.

Indices System - Best MT4 Examples Trading Systems

The trading system example above is comprised of four technical indicators in total, all of these generate Indices trade signals using different methods, the moving average will generate stock indices signals using the moving average crossover method shown, the RSI indicator, Stochastic indicator & MACD indicator use different technical analysis to generate the long and short signals as shown in the above example. How to generate these Indices signals is discussed in next topic (on sidebar navigation learn trading tutorials menu under key concepts).

For beginner traders, it is difficult for them to create their own indices trading strategies since they do not have a lot of knowledge about the stock indices trading market. However, this learn indices website will explain how a beginner trader can create their own free indices trading system in just seven easy steps. The best strategy is the one you come up with yourself & learn how to trade the stock indices trading market with it.

The main advantage of creating your own free indices systems is that you will know how to make profits by yourself - & not rely on other peoples efforts.

In the next indices trading course located at the sidebar navigation learn lessons menu below the indices trading key concepts will show you how to create a indices trading system like the one above, write it's indices trading rules & how to back test the system on a practice practice stock indices trading account before using it on a live stock indices trading account.

4 Examples of Free Stock Indices Trading Systems

Example 1: The Moving Average Crossover Method

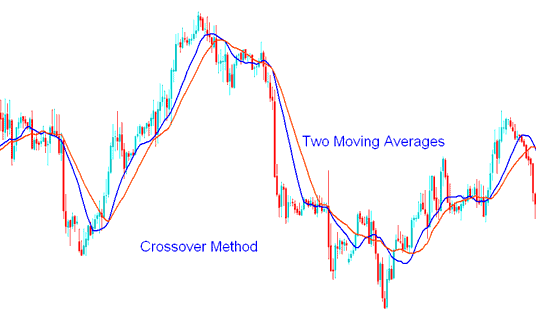

The moving average indicator cross over method uses two moving averages to generate Indices signals. First Moving average uses a shorter period and the second is a longer period.

Moving Average Crossover Technique - Moving Average Crossover Strategy

This above trading method is referred to as the moving average crossover method because stock index signals get generated when 2 averages cross above or below each other.

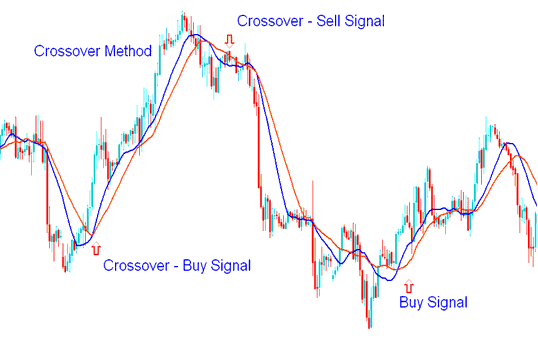

Indices Trading System Trading Example Template - Short and Long signal Generated by Trading System

A buy stock indices signal or going long trade is generated when the shorter moving average indicator crosses above longer moving average indicator (Both Moving Averages Going Up).

A sell stock indices signal or a going short trade is generated when the shorter average indicator crosses below longer moving average indicator (Both Moving Averages Moving Down).

Example 2: Stochastics Indices Trading System

Stochastic Oscillator technical indicator can be combined with other indicators to form a trading system.

- RSI indicator

- MACD indicator

- Moving Averages stock indices indicators

Trading Systems Examples - Best MetaTrader 4 Templates Example Systems

Short Signal or Sell Trading Signal

How the short sell Stock Indices signal was generated

From our indices trading rules the short signal is generated when:

- Both Moving Averages are heading down

- RSI is below 50

- Stochastic moving downward

- MACD heading downwards below centerline

The short signal was generated when all the written indices rules were met. The exit signal is generated when a stock indices signal in opposite trade direction is generated.

Good thing about using such a trading method is that we are using different types of technical indicators to confirm the stock indices signals & avoid as many whipsaws as possible in process.

- Stochastic -indices momentum oscillator indicator

- RSI -indices momentum oscillator indicator

- Moving Averages -indices trend following indicator

- MACD -indices trend following oscillator

Based on the chart time frame used - this strategy can be used as Indices scalping system when the minute stock indices charts are used or as a Indices day indices system when hourly stock indices charts are used.

Example 3: Trading System Indices Example

This system is fully described within the indices trading plan on the indices trading plan tutorial on this learn indices website under the key concepts section located on the right navigation menu.

Chart Time Frame

1 hour chart

Trading Indicators that spot a new indices trend

Moving Average Crossover Trading Indicators Strategy

Trading Indicators which confirm the indices trend

RSI indicator

STOCHASTIC OSCILLATOR trading indicator

Long Entry - Buy Signal

1. Both MA(moving averages) pointing up

2. RSI above 50

3. Both stochastics going up

Short Entry - Sell Signal

1. Both Moving Average pointing down

2. RSI below 50

3. Both stochastics going down

Exit Signal

1. Moving Average Trading Indicator gives opposite signal

2. RSI gives opposite signal

Risk Management in Stock Indices Trading

Stop loss- 35 pips

Take Profit Indices Order - 70 pips

Reward to Risk 2:1

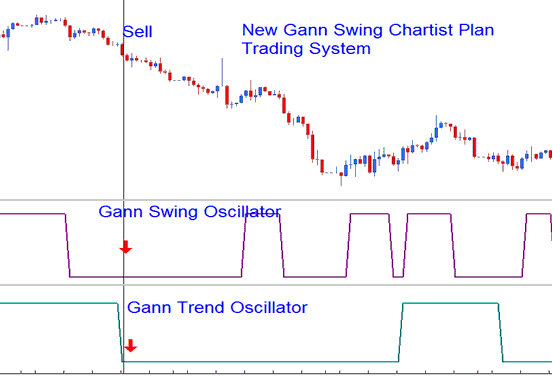

Example 4: New Gann Swing Indices Trading Chartist Plan

The Gann Swing Oscillator is meant to be used in combination with the Gann HiLo Activator and Gann Trend to form a complete strategy commonly referred to as the - "New Gann Swing Chartist Plan". Within this methodology the Gann Swing Oscillator is used to help determine stock indices market swings for trading only within the current market indices trend is illustrated by the Gann Trend.

Shown Below is examples of New Gann Swing Chartist Plan

Gann Chartist Plan - Indices Systems - MT4 Template Trading System