Technical Analysis and Trade Signals Derived from the Kase Peak Oscillator and Kase DevStop 2

Developed & Created by Cynthia Kase

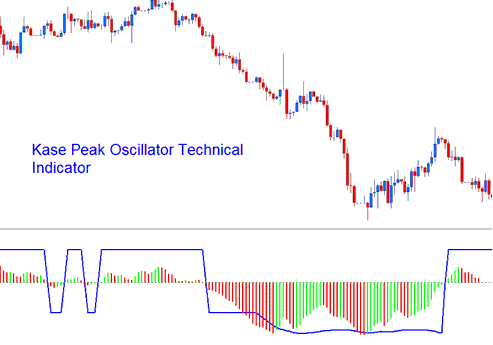

The Kase Peak Oscillator indicator is used in the same way as the other traditional oscillators indicators, but the oscillator is derived from a statistical evaluation of the trend: this statistical evaluation evaluates over 50 different trend lengths. The oscillator is capable of automatically adapting itself to the cycle length & volatility changes of the trend.

Kase Peak Oscillator Metric

Histogram readings that fall below the midpoint indicate bearish trends, while those above it suggest bullish conditions. Crossover signals serve as indicators for both entering and exiting trades.

Kase DevStop II Indicator

Developed & Created by Cynthia Kase

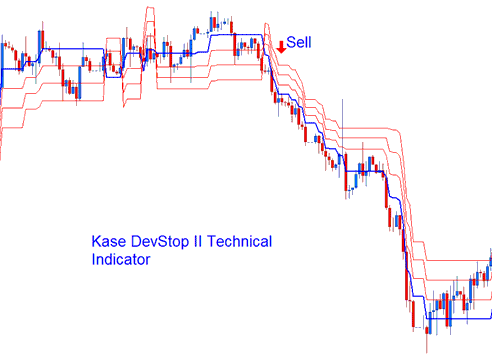

The Kase DevStop 2 metric calculates an average range and then derives three standard deviations from that range.

Index Analysis of the Kase DevStop II Technical Indicator

This Indicator is used to determine the realistic points to exit trade transactions based on volatility, variance of the volatility and the volatility skew. This indicator plots 4 lines. 4 lines are illustrated as a Warning Line and 3 Standard Deviation Lines of 1, 2 and 3. These lines allow traders to take profit order or cut losses at the levels where the probability of a trade remaining profitable is very low, at the same time without incurring more of a trading loss or cutting profit at any time sooner than it is necessary.

Kase DevStop 2

Stock traders use the three red lines for exits or stop losses. DevStop 2 follows market trends.

Study More Lessons:

- Description of Dow Jones Indicators for MT4

- Setting Up MA Envelope Trading Indicators on Charts in MT4

- Nasdaq Pips Value Calculator

- Analyzing Index Charts with the Aroon Oscillator Index

- Linear Regression Slope Indices Indicator Analysis

- Instructions for Logging In and Signing into a Real XAU/USD Account on MT4 Software for PC

- What Happens in Stock Index after Bearish Engulfing Candlestick Patterns?

- Obtaining Access to the SWI 20 Instrument in MT5 Software

- Method for Displaying Arrows on Stock Index Charts using the MetaTrader 4 Platform

- How to Add IT 40 in MetaTrader 4 iPad App