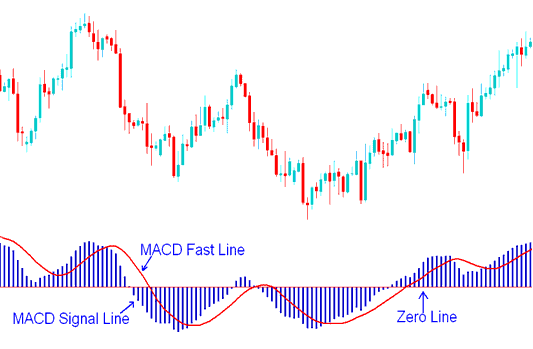

MACD Oscillator Indicator Analysis - Fast Line & Signal Line Insights

MACD indicator is used in various ways to give technical analysis data.

- MACD centerline crosses show bearish or bullish markets: below the zero is bearish, above zero is bullish.

- MACD Cross-overs indicate a buy/sell signal.

- Oscillations can be used to indicate oversold & over-bought regions

- Used to look for divergence between stock price & indicator.

Construction of MACD

The MACD technical indicator uses two exponential moving averages and draws two lines on the chart. The default moving averages are 12 and 26, and there's a smoothing factor of 9 applied when drawing the MACD.

How the MACD Indicator Gets Drawn: A Quick Summary

MACD is calculated using two Exponential Moving Averages (EMAs) along with a smoothing period (specifically, 12-period and 26-period EMAs, smoothed by a 9-period factor).

The MACD technical indicator only shows 2 lines, which are called the MACD fast line and the MACD signal line.

MACD lines include the fast line and signal line for trading cues.

- The FastLine is the difference between the 26 EMA and 12 EMA

- The Signal-line is the 9 period moving average of the MACD fastline.

Implementation of MACD

The MACD tool shows the MACD line as a solid line. The signal line appears as bars. Traders use their crossovers for signals.

The MACD centerline acts as the zero line, a neutral spot between buyers and sellers in the market.

Values situated above the central reference point are interpreted as favorable trading signals, whereas those beneath suggest negative stock signals upon analysis.

The MACD indicator being an oscillator, oscillates above & below this centerline.

Explore More Tutorials:

- How to Analyze MT4 Index Indicator Kase Peak Oscillator

- Index Trader Calculator Application

- Stochastic Indicator Overbought and Oversold Levels

- How Do You Interpret Stock Index Chart for Beginners?

- Description of How to Find EU 50 in MetaTrader 5

- How to Place Nas100 Trade in MetaTrader 4 for Android

- Placing the Relative Strength Index (RSI) indicator onto a stock index chart.