McClellan Oscillator Indices Technical Analysis & McClellan Oscillator Trading Signals

Developed by McClellan.

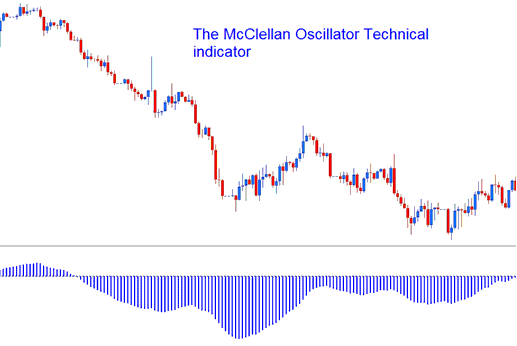

The McClellan Oscillator is an indicator that is based on smoothing the difference between the number of bullish candlesticks & bearish candlesticks. This stock indices technical indicator looks similar to the traditional MACD.

McClellan Oscillator

Indices Technical Analysis & How to Generate Trading Signals

This Oscillator is a momentum indicator that can be traded in the same way as the MACD indicator. There are Three techniques that McClellan Oscillator can be used to generate trade signals.

Zero Center Line Crossover Signals:

Bullish Signals- When the oscillator crosses above zero center-line a buy stock indices trade signal is given.

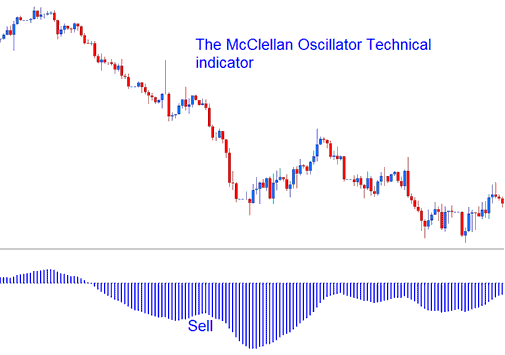

Bearish Signals- When the oscillator crosses below zero center-line a sell stock indices trade signal is given.

Technical Analysis in Indices Trading

Divergence Indices Trade Signals:

Looking for divergences between the McClellan Oscillator and stock indices trading price can prove to be very effective in spotting the potential reversal and/or trend continuation points in stock indices trading price movement.

There are several types of divergences:

Classic Stock Indices Trading Divergence (Regular Stock Indices Trading Divergence)

- Bullish Divergence: Lower lows in stock indices trading price action & higher lows in the McClellan Oscillator.

- Bearish Divergence: Higher highs in stock indices trading price & lower highs in the McClellan Oscillator.

Hidden Stock Indices Trading Divergence Setup

- Bullish Divergence: Higher lows in stock indices trading price action & lower lows in McClellan Oscillator.

- Bearish Divergence: Lower highs in stock indices trading price action & higher highs in McClellan Oscillator.

Overbought/Oversold Levels on Indicator

The McClellan Oscillator is also used to identify potential overbought and oversold levels in stock indices trading price action movements. The overbought and oversold conditions are generated when the oscillator moves to extreme levels on one side and starts to turn, however, in a strong trending market the oscillator will stay in the overbought and oversold levels for a long time. It is not recommended to trade overbought and oversold levels to generate trading signals. The best signal to use is the Centerline cross over signals to generate trade signals.