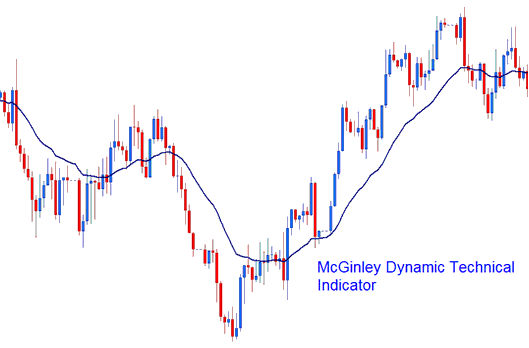

McGinley Dynamic Analysis and McGinley Dynamic Signals

Developed & Created by John McGinley

The McGinley Dynamic fixes the delay in simple and exponential moving averages. It adjusts to market speed on its own. That's why it's called dynamic.

This indicator closely tracks price movements in both rapidly and slowly moving markets.

Stock Analysis and How to Generate Trading Signals

This indicator is more effective at preventing whipsaws compared to the original moving average.

Determined by applying the formula:

Dynamic = D1 + (Price - D1) / (N (Price/D1)4) if is dynamic.

D1 = the previous value of the Dynamic indicator

N = smoothing value (for price periods)

^ = Power of

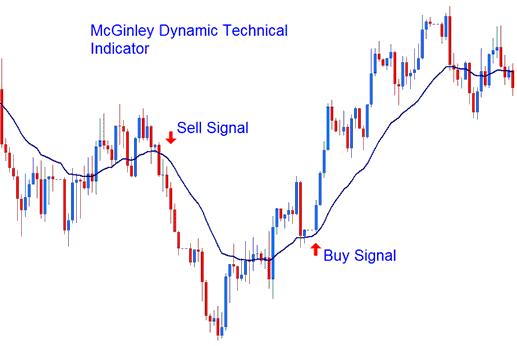

Bullish, Buy Trading Signals and Bearish, Sell Trade Signals

McGinley Dynamic should be combined with moving averages to form a trading strategy. McGinley Dynamic should be used as the smoothing mechanisms where the MA Moving Average is choppy or oscillating.

- Bullish, Buy Trading Signal - A buy trade signal is generated/derived when stock price is crosses above the indicator.

- Bearish, Sell Signal - A sell stock signal is generated when stock price is crosses below the trading indicator.

Analysis in Indices Trading

Review Further Subject Areas and Instruction Sets:

- What's UKX100 Spreads? UKX100 Bid Ask Spread

- Index Trade Identify Flag Setup

- How Can I Trade SWI 20 in MT4 Software Platform?

- Where to Get SWI20 in MetaTrader 5 Software Platform

- MACD Center-line Crossover Strategy

- Example of How to Know When a Stock Index Down Trend is Starting

- Pivot Points Breakout: Index Indicator Guide

- US30 Indices Strategy and US30 Forex Strategy

- Locating Nasdaq on the MT4 Platform

- How to Put the MA Oscillator Tool on a Stock Index Chart