Momentum Indices Technical Analysis & Momentum Oscillator Trading Signals

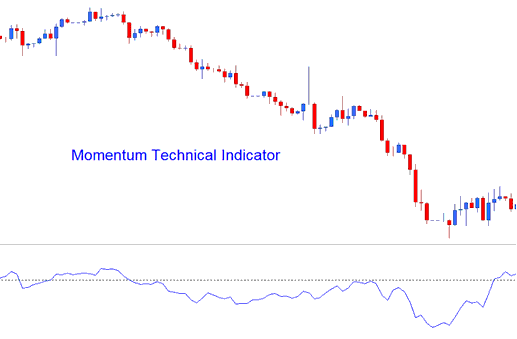

The momentum indicator uses math equations to calculate line of plotting. Momentum measures the velocity with which stock indices trading price changes. This is calculated as a difference between the current stock indices trading price candle & the average stock indices trading price of a chosen number of stock indices trading price bars ago.

Momentum represents the rate of change of the stock indices trading price over those specified time periods. The faster that indices trading prices rises, the bigger the increase in momentum. The faster that indices prices decline, the bigger the decrease in momentum.

As the stock indices price movement begins to slowdown the momentum also will begin to slowdown and return to a median zone.

Momentum

Indices Technical Analysis & How to Generate Trading Signals

This stock indices indicator is used to generate technical buy and sell trading signals. The 3 most common techniques of generating trading signals used in indices trading are:

Zero Centerline Indices Trading Cross Overs Stock Indices Trade Signals:

- A buy stock indices signal is generated when Momentum crosses above zero

- A sell stock indices signal is generated when Momentum crosses below zero

Overbought/Oversold Levels:

Momentum is used as an overbought/oversold indicator, to identify potential overbought & oversold levels based on previous readings: the previous high or low of the momentum is used to figure out the overbought & oversold levels.

- Readings above the overbought level mean indices is overbought and a indices price correction is pending

- While readings below the oversold level the stock indices trading price is oversold & a indices price rally is pending.

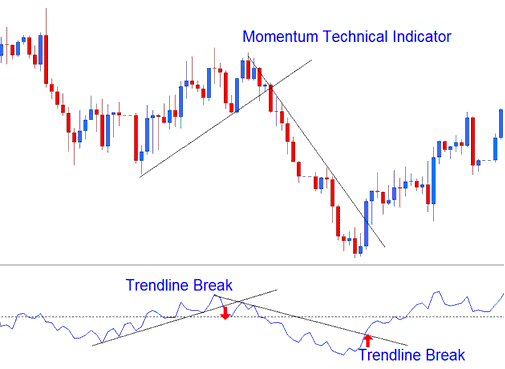

Indices Trend Line Break Outs:

Indices Trend lines can be drawn on the Momentum indicator connecting the peaks and troughs. Momentum begins to turn before stock indices trading price therefore making it a leading indicator.

- Bullish reversal - Momentum readings breaking above a downwards indices trendline warns of a possible bullish reversal stock indices signal while

- Bearish reversal - momentum readings breaking below an upward indices trend line warns of a possible bearish reversal indices trade signal.

Technical Analysis in Indices Trading