MA Technical Analysis and MA Trading Signals

This trading tool finds the usual amount of market prices (or any specific data) over a set amount of time.

The real difference between types of moving averages comes down to how much weight they give to recent data. Simple moving averages treat all prices equally, while exponential and weighted averages give more importance to the latest prices.

Explanation

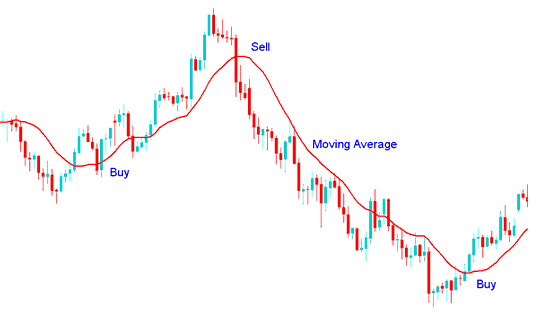

Traders often read the MA indicator by checking how the price moves against its own average. A buy comes when price climbs over the MA. A sell follows when price dips under the Moving Averages.

MA Indicator

buy and sell signals generated by means of MA(shifting common) crossing above/below buying and selling rate motion.

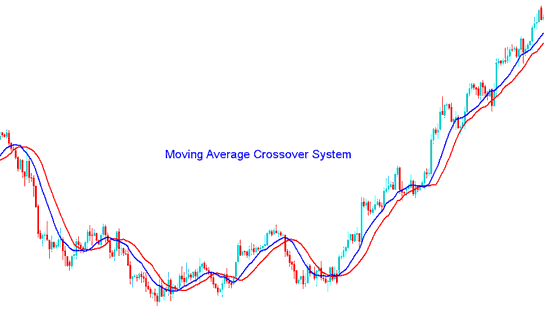

MA Cross over Method

MA crossover methods draw big crowds too. They often use two or more MAs that cross paths. Some add other tools for entry and exit signals. Options for these setups seem endless.

Moving Average Cross-over System

Learn More Lessons and Tutorials & Topics:

- Stock Index Indicators – What Every Trader Should Know

- Strategies for Stock Indices

- Accessing GDAXI 30 Index on the MT5 iPad app easily described.

- Analyzing Index Trading Strategies Using the MACD Fast Line and Signal-Line

- What does the EUROSTOXX50 Chart display?

- How to Add GER 30 on MT5 Android Trade App

- Searching for S&P ASX on the MetaTrader 4 app for iPad? Here's how to find it.

- Best Tutorial for AUS200 Trading Strategy