MA System Explained

Stock Indices 20 Pips Moving Average Strategies

The 20-pip moving average plan fits 1-hour and 15-minute stock charts. We add 100 and 200 simple moving averages on these.

The trend direction will be found using the 100 and 200 SMA (SMA Technical Indicator) on both the 1 Hour and 15 minute charts.

The 1-hour chart is great for checking the market's long-term trend - up or down - by following the moving averages. Any trade you take should line up with that trend.

We utilize the 15-minute chart to identify the optimal entry points for stock trades. Trades are initiated only when the stock price is within a 20-pip range of the 200 simple moving average: if the stock price does not fall within this pip range, stock trade positions will not be opened.

Uptrend/Bullish Market

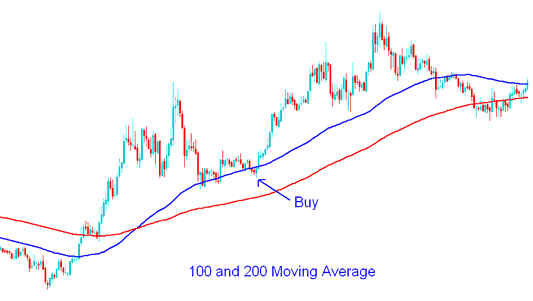

For buy signals with the 20-pips moving average plan, pick the 1-hour or 15-minute chart.

On the H1 chart, the stock price should be higher than both the 100 and 200 simple moving averages. Then, we switch to a shorter chart, the 15-minute one, to get a trading signal.

On 15-minute charts, buy when price hits 20 pips over the 200 SMA. Set stop loss 30 pips under it. Adjust stops to fit your risk, but 30 pips skips normal index shakes.

Open a buy when stock price hits the 100 simple MA. Make sure it's close to the 200 SMA, within 20 pips.

100 and 200 Simple MA Buy Trading Signal - MA Strategy

Downtrend/Bearish Market

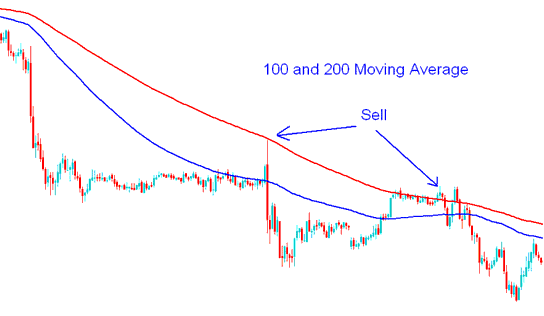

To produce sell (short) signals using the 20-pip moving average method, we will also apply the 1-hour chart and the 15-minute chart time frames.

On the 1-hour chart, price sits below 100 and 200 SMA. Switch to 15-minute for the signal.

On a 15-minute stock chart, if the price drops to 20 pips below the 200 SMA, we initiate a sell indices trade and set a stop-loss order 30 pips above the 200 simple MA.

100 and 200 SMA Crossover for Sell Signals - MA Strategy

With this way of trading, the price will usually bounce off these support and resistance levels because many traders watch these areas, and they start similar stock trades at about the same price point.

Support and resistance lines serve as short-term barriers in stock charts.

profit booking level for This Strategy

With this strategy, stock price bounces back to the main trend. The move often hits 60 to 70 pips.

Consequently, the optimal level for securing gains would plausibly be situated between 60 and 70 pips distant from the 200-period Simple Moving Average (SMA).

Get More Tutorials and Courses at:

- Parabolic SAR Indices Indicator Analysis on Index Charts

- Dark Cloud Candlestick Opposite Piercing Line Candle

- SX 5E Indices Method: How to Build a Stock Index Strategy for the SX 5E Training Course

- Location Details for Finding the S&P ASX 200 Symbol on MT4

- How to Read the MT4 Fibonacci Extensions Tool in MetaTrader 4 Platform

- Finding the DJI30 Index Symbol within the MT4 iPhone Application

- HK 50 Trading Method How to Develop Stock Index Strategy for HK 50 Lesson Guide

- Setting up Fibonacci Extension on MetaTrader 4 Index Charts

- An Example Trading Strategy for the GER 30 Index

- How to Place US 500 on MT4 iPad App