Analysis of MA(Moving Average) Indicator

Index Trend Identification

The Moving Average (MA) technical indicator can function as a tool for signal generation. A directive to either buy or sell arises when the price crosses above or below the MA, respectively.

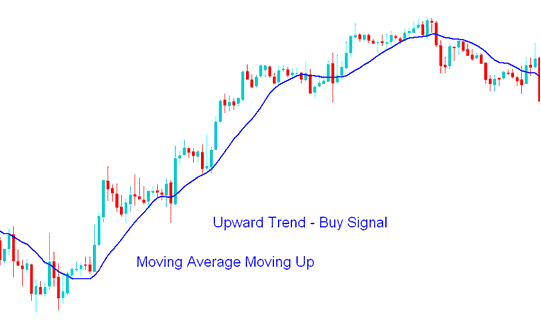

If the Moving Average is slanting upward, it signifies a general upward market trend.

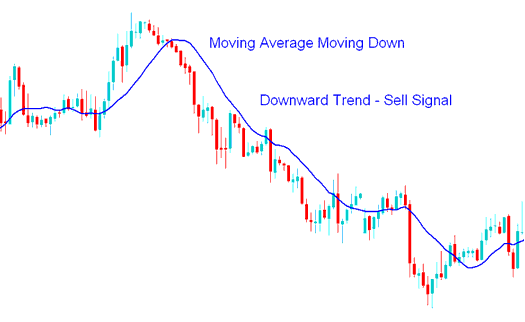

Conversely, if the MA is trending downward in a diagonal fashion, the overall trend is downward.

Up-ward Trend/Bullish Trend

Upward MA means an uptrend. This creates a buy signal.

If the price stays above the moving average, the market will keep going up. The MA will act like a 'support zone,' and chart candles shouldn't end below the MA.

Buy Signal

A buy signal is officially generated when the price moves above a Moving Average and subsequently records a candle close above that MA line.

Index Traders, who want to confirm the signal before implementing it, should wait until the Moving Average line turns and starts to move in an upwards trend direction. It's always best to wait for the confirmation signal to reduce odds of a whipsaw.

A Comprehensive Guide on Day Trading Index: Strategies and Methods for Day Trading

Downwards Trend/Bearish Market

If the MA is trending downward, it indicates that the trend is negative and the generated signal is a sell/short signal.

If the price stays below the MA, the market will keep going down. The MA will act like a "resistance area," and candlesticks shouldn't end above the MA.

Sell Trading Signal

A sell trade signal is generated when the price moves beneath the Moving Average and subsequently closes below that same moving average line.

People who want to be extra sure about the trading signal should wait for the MA line to change direction and start going downwards, which will lower the chances of a whipsaw trade.

A comprehensive guide explores day trading methods and strategies for navigating downward trends in index markets efficiently.

Index Range Market signals

Range Trading Market signals can also be recognized using the Moving Average Indicator.

Moving Average Cross over System Strategy

The MA crossover method is just another way to find trading signals that's more liked by traders than the signal method above. A moving average cross-over trading plan is also the easiest kind of trading plan that is very common with stock traders online. This Moving Average crossover is used together with other tools to create systems and plans that are more complex.

Obtain Further Programs & Instructional Material: