Short-Term and Long-Term Price Period of Moving Averages(MA)

A trader has the option to modify the price bar periods utilized for calculating the MA.

If a trader uses short price periods then the Moving Average will react faster to the changes in the price.

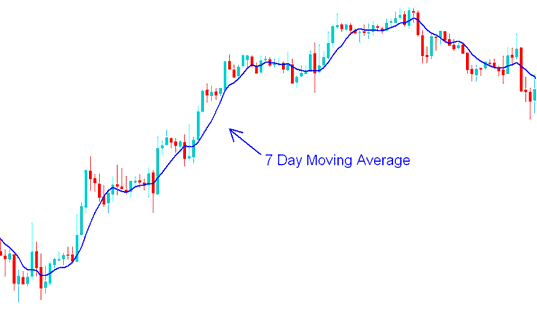

For instance, if an indices trader uses the 7-day trading moving average, the moving average indicator will react to price changes much faster than a 14-day or 21-day trading MA would. But, using short trading price periods to calculate the Moving Average might cause the technical indicator to give incorrect signals (whipsaw signals).

7 Day Moving Average(MA) - MA Indices Strategies Methods

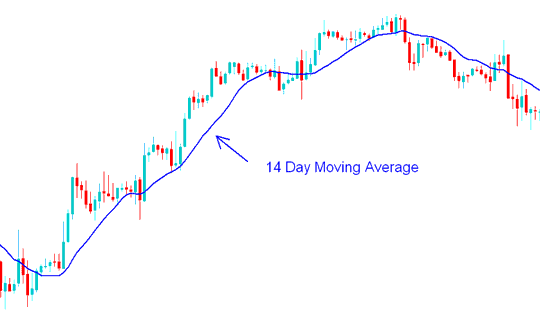

If another person trading uses chart periods that cover more time, then the Moving Average will change more slowly to price changes.

For instance, a 14-day moving average avoids false signals but lags behind quick changes.

14 Day Moving Average(MA) - MA Moving Average Strategy Example

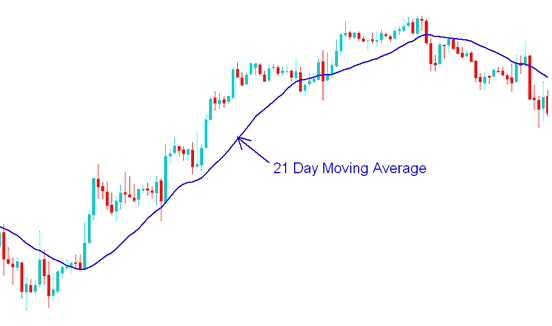

21 Day Moving Average(MA) - MA Indices Strategies Example

Get More Lessons:

- How to Add Accelerator Oscillator on Stock Index Chart in MetaTrader 4 Software Platform

- How can I find SMI20 on the MetaTrader 4 iPad app?

- How do you analyze the DeMarker Index indicator?

- DAX Trading on the MetaTrader 4 Platform

- Steps to Access and Configure NKY225 on the MT5 Mobile Application

- Procedures for Incorporating the FTSE MIB 40 Index into MetaTrader 4 Software

- Educational Guide to Trading the Nikkei225 Stock Indices

- DAX MetaTrader 4 DAX Platform Software