Multiple Timeframe Analysis

Looking at multiple time-frames means using 2 chart time frames to trade indices - a quicker one for trading and a slower one for trend check.

Follow the trend for best results. In multi-timeframe analysis, the longer frame sets the long-term direction.

If the market is going in one direction for a long time, and the shorter timeframe agrees, you have a much better chance of making money. This is because even if you mess up, the long term trend will probably help you out. Also, if you trade with the way prices are going, you'll usually win, and that's what this market analysis is about.

Many indices and stock traders say, "The trend is your friend." Always trade with the market, not against it.

There are 4 types of traders - each one uses different charts to trade as shown and explained below.

Examples Explain How Traders Use Multiple Timeframes for Indices Analysis

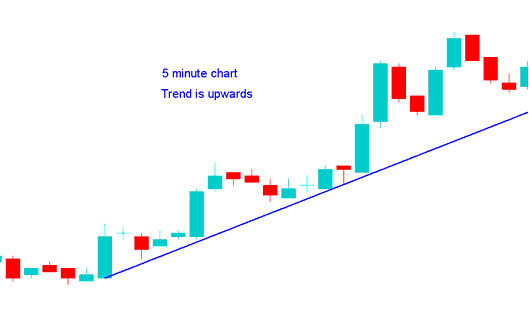

Scalpers

This group maintains their positions for only a very short duration, typically just a few minutes. Scalpers rarely keep a trade open for longer than ten minutes, aiming primarily to secure small profits: ranging from 5 to 20 pips.

A scalper on a 1-minute chart wants to buy. They check the 5-minute chart, which shows an upward trend. The analysis confirms it's safe to enter the trade.

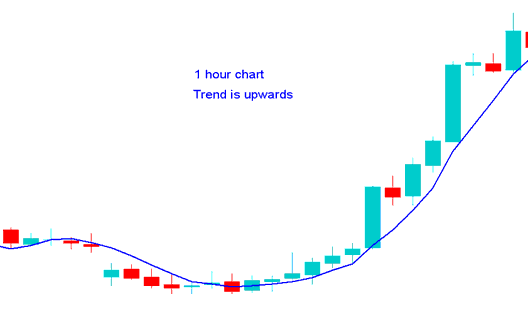

Day Traders

This category of traders typically holds positions for several hours, but not exceeding one day, with the goal of capturing a substantial number of pips, ranging from 30 to 100.

A day trader using a 15-minute chart wants to enter a long position. They check the H1 chart, which looks like the one below. The H1 shows an upward market trend. From this review, they decide it's fine to buy.

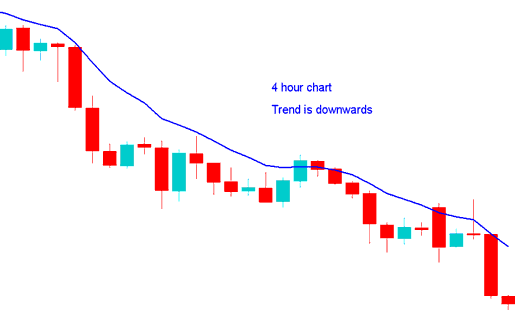

Swing Traders

This group keeps their trades open for a few days to a week, aiming to gain a significant number of pips, like 100 to 400 pips.

A swing trader using the H1 chart wants to sell, looks at the 4 H chart, which is like the stock trading example shown below: because the 4-hour chart shows the market is going down, they decide it is okay to sell based on the analysis.

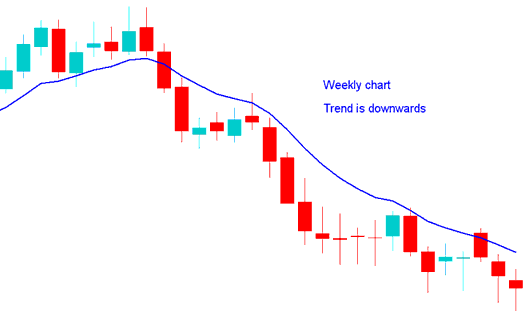

Position traders

These are the traders who maintain their trade positions open for durations spanning weeks or even months, targeting substantial pip gains, typically ranging from 300 to 1000 pips.

A trader who holds positions for long using the daily chart wants to sell, looks at the weekly chart, and the weekly chart looks like the one below, which shows the market is going down, so they decide it's okay to sell.

How to Define A Trend

This system uses three indicators: MA cross-over, RSI, and MACD. It follows simple rules to spot trends.

Upward trend

Both MAs Moving Up

RSI Indicator above 50 Mark

MACD Above Center-line

Downwards Trend

Both MAs Moving Down

RSI Indicator below 50 Mark

MACD Below Center-Line

For More details and particulars about this system read: How to Generate Trade Signals with a System.

More Topics and Courses: