Reversal Stock Indices Candlestick Patterns - Piercing Line Indices Candle Pattern

Bullish Indices Candle Patterns Tutorial and Bearish Stock Indices Candlestick Patterns Guide

A Piercing Line Stock Indices Candlesticks Pattern & Dark Cloud Cover Stock Indices Candles Pattern look alike but the difference is that one occurs at the top of a Indices Trading up trend (Cloud Cover) and the other occurs at the bottom of a downwards indices trend (Piercing).

Upward Indices Trend Reversal - Dark Cloud Cover Candlesticks Patterns

Downward Indices Trend Reversal - Piercing Line Candles Patterns

Piercing Line Indices Candle Pattern

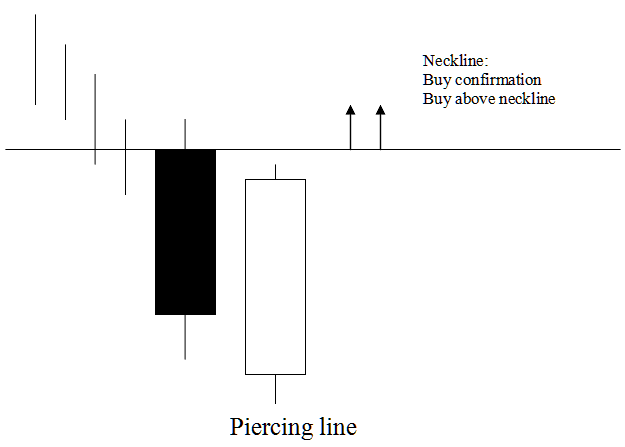

Piercing line candlestick pattern is a long black body followed by a long white body candle.

White body pierces the mid point of the prior black body.

Piercing line candle pattern is a bullish reversal indices pattern that forms at the bottom of a stock indices market downwards indices trend. Piercing line candlestick pattern shows that the stock indices market opens lower & closes above midpoint of the black body.

Piercing line candle pattern shows that the momentum of the down indices trend is reducing & indices trend is likely to reverse & move in an upwards direction.

Piercing line candle pattern is shown below and it is known as a piercing line because it signifies that the stock indices market is piercing the bottoms showing a market floor for stock indices price downwards trend.

Piercing Line Indices Candle Pattern

Technical Analysis Piercing Line Indices Candlesticks Pattern

A buy stock indices signal is confirmed once stock indices price closes above the neck-line which is the opening of the candlestick on the left of the Piercing Line candle pattern.

This is a bullish stock indices candlestick pattern setup and stock indices price should continue moving upwards and for a trader who puts a buy indices trade - should place stop loss stock indices orders just below the lowest stock indices price region.