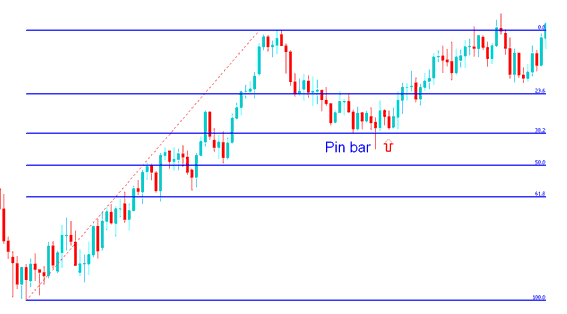

Pin bar stock indices trading price action method

A pin bar is a reversal stock indices signal on a stock indices chart which displays an obvious change in sentiment during that trading period.

This bar has a long tail with closing stock indices price near the open.

Bar looks like a pin thus the name Pin Bar - forms after an extended trend move upward or downward.

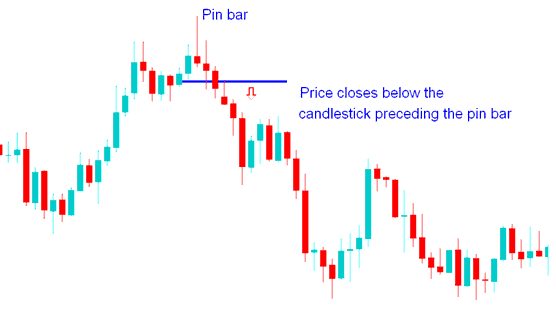

This reversal is confirmed after market closes below the candle that precedes this pattern. Below the reversal is confirmed after the stock indices trading market closes below the blue candlestick that preceded this candle.

Combining with line studies:

This signal can be combined with other line studies such as Support and Resistance levels, Fibonacci retracement levels and indices trendlines can be used together with this stock indices signal to generate buy or sell stock indices trades.

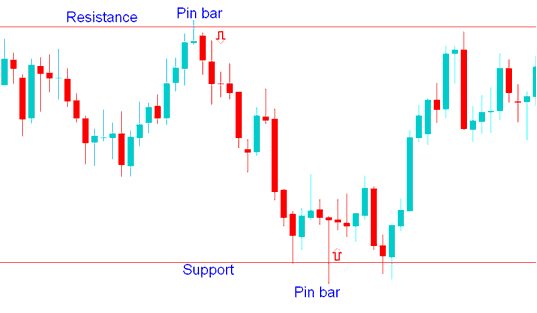

Support and resistance

A pin bar that forms after stock indices price hits an important support or resistance level can be used as a signal to enter the stock indices market. When this pattern forms the trades taken should be in the opposite direction of the tail.

If the stock indices trading market moves up this forms a pin bar with tall upper tail, then the signal is to short.

If the stock indices trading market moves down the forms a pin bar with tall lower tail, then the signal is to long.

Combining with Support & Resistance

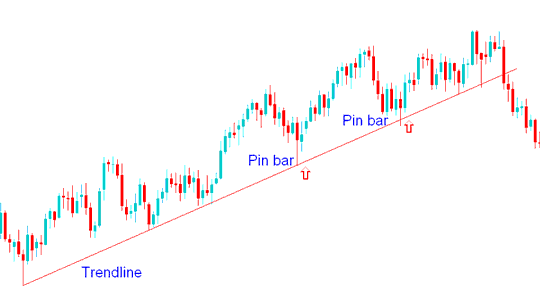

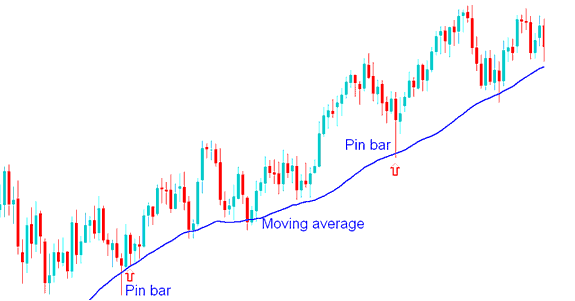

Indices Trendlines & moving averages

Pin bars that form after stock indices trading price touches a indices trend line or moving average can be used as signals to enter the stock indices trading market.

Combining with Indices Trendlines

Combining with Moving Averages

Stock Indices Fibo Retracement Levels

Pin bars that form after stock indices trading price touches a Fibonacci retracement level can also be used as signals to enter the stock indices trading market.

Combining with Stock Indices Trading Fibo Retracement Zones

These trading patterns are often created near extremes in market swings, and they often happen at after false breakouts. This is why this pattern is used to place trades in the opposite direction of the tail.