Pivot Points Analysis and Pivot Point Signals

This indicator features a central pivot surrounded by three resistance levels below and three support levels above.

Floor traders first used these points for equities and futures. The indicator leads rather than lags.

Pivots offer a simple way for stock traders to study and understand the overall direction the market is likely to move during the trading day. Simple math is used to find the areas of resistance and support.

To calculate these points for the coming day, the previous day's

- high,

- low, and

- closing prices are used

The trading day concludes, and this daily closing time is when the indicator receives its update.

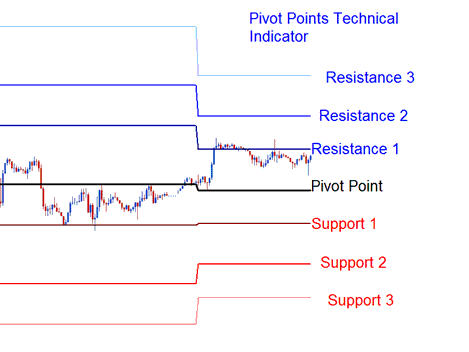

The calculations for this trading technical indicator's 24-hour cycle utilize a sophisticated formula. The center pivot point is employed to assess the areas of support and resistance as outlined below:

Resistance 3

Resistance 2

Resistance 1

Pivot Point

Support 1

Support 2

Support 3

Indices Analysis and Generating Signals

This indicator can be used in several ways to make trade signals. Here are the most used ways to look at the market technically:

Indices Trend Identification Signals

Stock traders utilize the center pivot to ascertain the overall direction of the market trend. The trade positions that will be established and initiated will only be in the trend's direction.

- Buy signal - stock trading price is above the central point

- Sell signal - stock price is below the central point

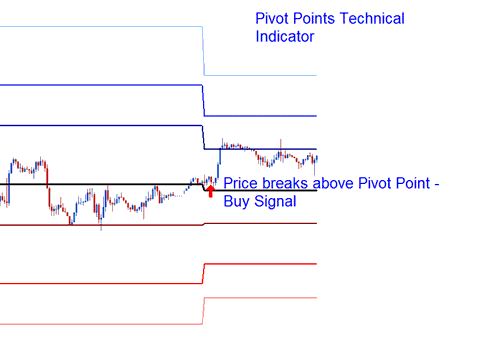

Indices Price Break-out Signals

Index Price break out signals are derived and generated as follows

- Buy signal- is generated when the price breaks upwards through the central point.

- Sell signal- is derived & generated when the price breaks out downward through the central point.

Indices Price Break-out

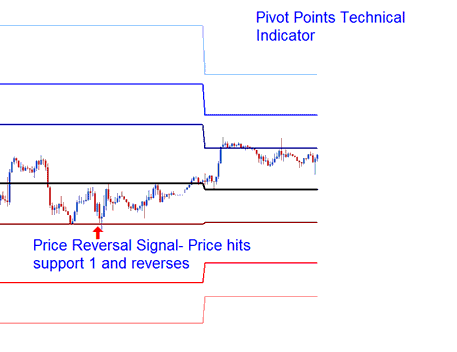

Index Price Reversal Signal

Indices Price reversals are derived and generated as follows

Buy Signal- when trading price moves down towards one of the support area, then touches the support or moves slightly through it then quickly reverses and moves upwards.

Sell Signal- when the price goes up toward a level where it usually stops, touches it or goes a bit past it, then quickly turns around and goes down.

Indices Price Reversal Signal

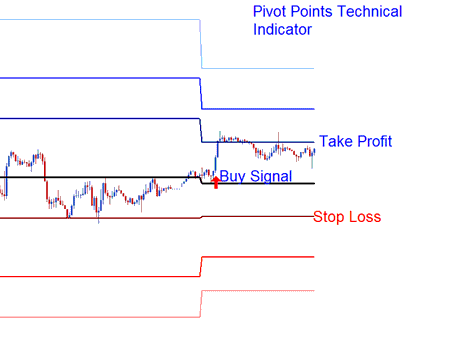

Setting Stop loss and Limit Profit Values

Stock traders use the central pivot and support or resistance levels to set stop losses and take-profit points.

Setting Stop loss and Limit Profit

If a buy signal happens above the middle point, Resistance One or Resistance Two can be used to decide where to set the take profit order, and Support 1 can be used as a Stop Loss Zone for the position.

To download Pivot points Trading Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

after downloading the indicator. Use the Meta Editor of the MQL4 Language to open it, and then press the Compile Button to compile the indicator, which will be added to your MT4.

Note: After installing this on your MT4, the indicator features supplementary lines labeled "Mid-Points." To eliminate these extra lines, access the MQL4 Meta Editor (quick keyboard command: F4) and modify line 16 from:

Extern bool midpivot = true:

To

Extern bool mid-pivot = false:

Subsequently, depress the Compile button once more, and the indicator will be displayed exactly as illustrated on this online location.

Get More Topics and Lessons:

- Finding the WallStreet30 Instrument within the MetaTrader 4 Application for iPhone Trading

- RSI Index Hidden Bullish Divergence and RSI Hidden Bearish Trading Divergence Trading Setups

- Defining the SX5E Indicator within MT4 Tools

- Developing a Structured Strategy for Trading Stock Indices Utilizing Systematic Approaches.

- Clarification of NETH 25 Spreads: The NETH 25 Bid/Ask Difference

- How to Add the CAC40 Index on the MT5 Android App

- Studying Stock Index Charts Using the Aroon Stock Indices Indicator

- Demo Application for MT4 Index Trading