Rate of Change Indices Technical Analysis & Rate of Change Trading Signals

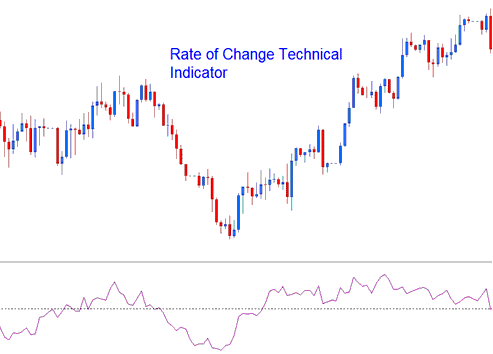

Rate of Change indicator is used to calculate how much stock indices trading price has changed within a specified number of stock indices trading price periods. It calculates the difference between the current candlestick and the stock indices trading price of a chosen number of previous candles.

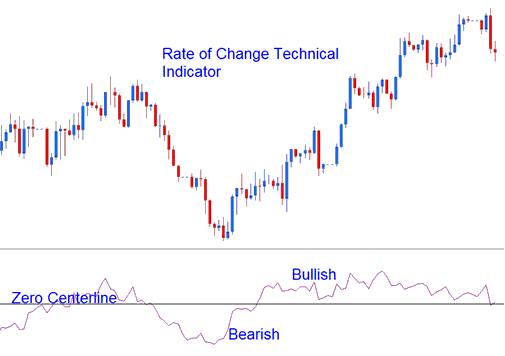

The difference can be calculated using Points or Percents. Rate of Change moves in an oscillation manner, where it oscillates above & below a zero center-line level. Levels above zero are bullish while those below zero center-line level are bearish.

The greater the changes are in the indices trading prices the greater the changes in the ROC.

Stock Indices Technical Analysis & How to Generate Trading Signals

Rate of Change indicator can be used to generate stock indices signals using a number of methods, the most common ones are:

Stock Indices Trading Cross Over Trade Signals

Bullish Signal - buy stock indices signal is generated when the ROC crosses above the zero center line

Bearish Signal - sell stock indices signal is generated when the Rate of Change crosses below the zero center line.

Overbought/Oversold Levels:

Overbought - The higher the reading the more overbought indices is. Values that are above the overbought level imply that a indices trading price is overbought and there is a pending stock indices trading price correction

Oversold - The lower the reading the more oversold indices is. Values below the oversold level imply that indices is oversold and there is a pending stock indices trading price rally.

However, during strong trending markets the stock indices trading price will remain in the Overbought/Oversold Levels for a long time, and rather than the stock indices trading price reversing the stock indices price trend will continue for quite some time. It is therefore best to use the crossover signals as the official buy and sell stock indices trade signals.

Indices Trend Line Breaks

Indices Trend lines can be drawn on ROC indicator just the same way trend lines can be drawn on stock indices trading price charts. Because The Rate of Change is a leading indicator, the trendlines on the indicator will be broken before those on the stock indices trading price charts. A indices trend line break on the Rate of Change is an indication of a bullish or bearish reversal indices trade signal.

- Bearish reversal- Rate of Change readings breaking above a downwards indices trendline warns of a likely bullish reversal.

- Bearish reversal- Rate of Change readings breaking below an upwards indices trendline warns of a likely bearish reversal.

Divergence Indices Trading

Rate of Change can be used to trade divergences, and to identify potential indices trend reversal trading signals. There are four types of divergences: classic bullish, classic bearish, hidden bullish and hidden bearish divergence.