RVI Technical Analysis & Relative Vigor Trading Signals

Developed and Created by John Ehler

The RVI takes old trading ideas and mixes them with new digital signal processing theories and filters to make a trading indicator that is useful and realistic.

The fundamental concept behind it is straightforward -

- Prices will tend to close higher than they open in up-trending markets and

- Prices close lower than where they open in down-trending markets.

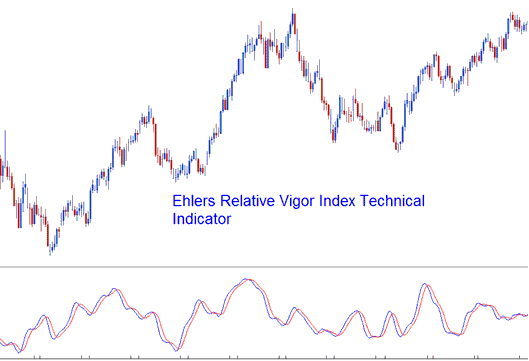

So, how strong the move is will be shown by where prices end up when the candlestick closes. The RVI shows 2 lines, the RVI Line and the trade signal Line.

The RVI index fundamentally measures the average difference between closing and opening prices, which is then averaged against the typical daily trading range and subsequently plotted.

It acts as a quick oscillator. Turning points match stock price cycles.

Technical Analysis & How to Generate Signals

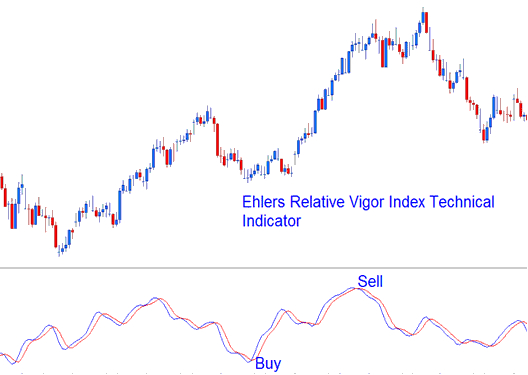

The RVI acts as an oscillator. Look for crossovers between the RVI line and its signal line to spot signals.

A buy stock signal hits when RVI crosses over the signal line.

Bearish signal hits when RVI drops below its signal line for a sell.

Purchase and Sale Indications for Stocks Produced through the Crossover Technique

Explore More Lessons and Classes:

- Interpreting Fibonacci Extension Levels on Stock Index Trading Charts

- SMA, EMA, LWMA and SMMA. Types of Stock Index MAs MAs Moving Averages MAs

- Procedure for Adding the NASDAQ 100 Stock Index to the MT4 Software

- Study How to Trade SX5E Index Guide

- Studying Index Trend Following Strategies

- Grid, Volumes, AutoScroll & MT4 Chart Shift on MT4 Software