Bullish Stock Candle Patterns and Bearish Stock Candle Patterns

Bullish Candlestick Patterns Tutorial Course & Bearish Stock Candlestick Patterns Lesson

Reversal candlestick patterns materialize succeeding a sustained prior market direction. Therefore, for any candle pattern setup to qualify as a valid reversal signal, an established prior trend must be present.

These reversal candle patterns are:

- Hammer Candlestick Pattern and Hanging Man Stock Candlestick Pattern

- Inverted Hammer Candlestick Pattern and Shooting Star Stock Candlestick Pattern

- Piercing Line Candle Pattern and Dark Cloud Stock Candlestick Pattern

- Morning Star Candlesticks and Evening Star Candles

- Engulfing Candles Patterns

Hammer Candlestick Pattern & Hanging Man Candlestick

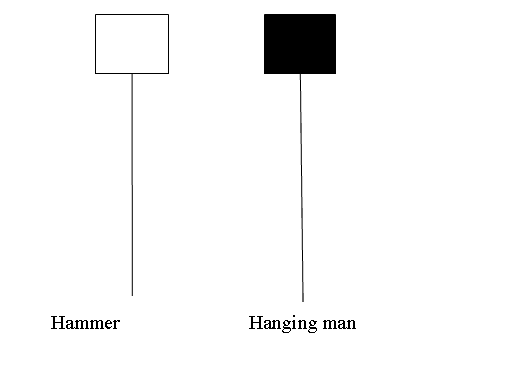

Hammer and hanging man candlesticks look alike. The hammer signals a bullish reversal. The hanging man points to a bearish one.

Hammer Candlestick Pattern & Hanging Man Candlestick Pattern

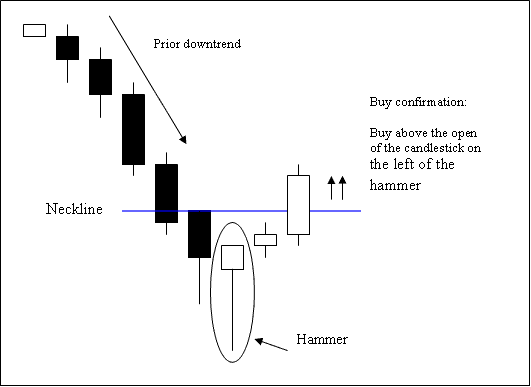

Hammer Candlestick

A Hammer is a pattern that might mean prices will go up, and it happens when prices have been going down. It's called that because the market is forming a bottom.

A hammer has:

- A small body

- The body is at the top

- The lower shadow is 2 or 3 times the length of real body.

- Has no upper shadow or has a very small upper shadow if present.

- The colour of the body isn't important

Hammer Candlestick

Technical Analysis of Hammer Candle-sticks Pattern

A buy signal confirms when a candle closes above the open of the candle just before the hammer pattern.

Stop orders should be set a few pips just below low of the hammer candlestick.

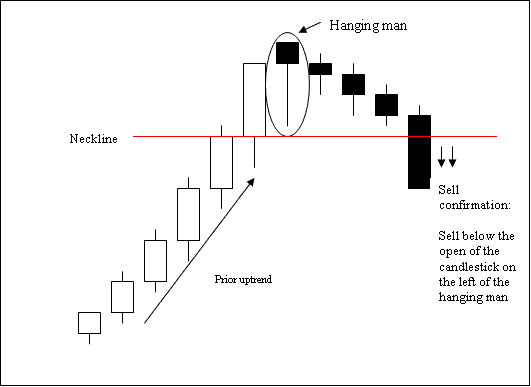

Hanging Man Candlestick

This setup is a bearish reversal signal during an uptrend. It's called a “hanging man” because the pattern kind of looks like a person hanging from a noose.

A hanging man candlestick has:

- A small body

- The body is at the top

- Lower shadow is 2 or 3 times the length of real body.

- Has no upper shadow or has a very small upper shadow if present.

- The color of the body isn't important

Hanging Man Candlestick

Trading Analysis of the Hanging Man Candles

A sell signal confirms when a bearish candle closes below the open of the candle before the hanging man pattern.

Stop orders should be set a few pips just above high of hanging man candlestick.

Get More Guides & Guides:

- What is Margin Requirement for 1 Contract of EU50 Index?

- Where Can Find IBEX in MT5 Platform?

- Where Can I Study How to Trade Index in MetaTrader 4 App

- How to Add IT 40 in MetaTrader 4 iPad App

- Stock Indices Strategies for Stock Index NIKKEI 225 Stock Indices

- Transforming Your Stock Index Trade Psychology Mindset To Improve Your Stock Indices Trade

- MACD Index Trading Method Technical Analysis Summary

- How Can I Place SWI 20 in MT5 iPhone App?

- Trade Strategies for Trading SMI 20 Indices