RSI Stock Analysis and RSI Signals

This methodology was pioneered by J. Welles Wilder and is comprehensively detailed within his publication, "New Concepts in Technical Strategies".

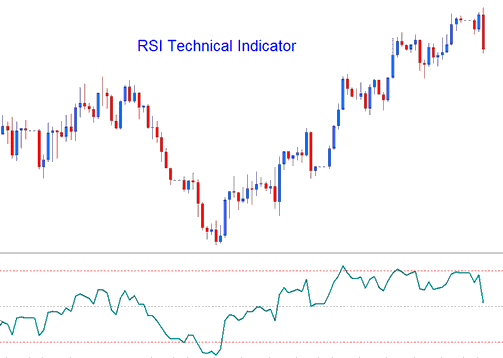

The Relative Strength Index (RSI) is a widely favored trading indicator, functioning as both a momentum oscillator and a trend-following technical tool. It measures the size of recent price gains in comparison to recent losses, displaying this information on a scale that ranges from 0 to 100.

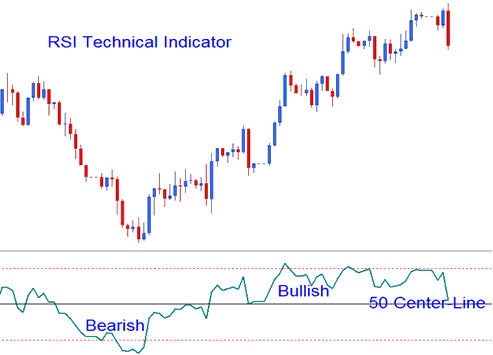

The Relative Strength Index evaluates the momentum of indices: readings exceeding 50 indicate bullish momentum, whereas values below the 50 center line suggest bearish momentum.

- RSI is drawn as a green line

- Horizontal dashed lines are drawn to identifying overbought and over-sold levels are i.e. 70/30 levels respectively.

Stock Analysis and Generating Trade Signals

There are several different techniques used to trade, these are:

50-level Cross over Signals

- Buy trade signal - when the indicator crosses above 50 center mark a buy/bullish signal is generated.

- Sell Signal - when the indicator crosses below the 50 a sell/bearish signal is given.

RSI Stock Index Setup Patterns

Draw trend lines on RSI charts. Spot patterns like head and shoulders there. They may not show as clear on the price chart itself.

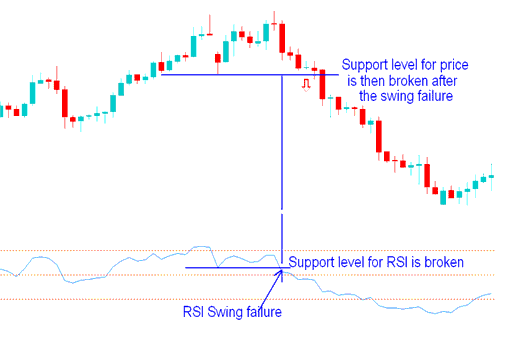

Indices Support/Resistance Breakouts

As a leading indicator, the RSI can forecast Support and Resistance breakouts prior to the actual breach of the price level. The RSI employs the swing failure signal to anticipate when price movements are imminent to break through resistance and support areas.

Swing Failure - Support and Resistance Break-out

Over-bought/Oversold Conditions in Indicator

- Overbought levels above 80

- Oversold - levels below 20

You can use these levels to generate signals - like buying when RSI turns up from below 20 after being oversold, or selling when RSI drops below 80 after being overbought. But honestly, these signals aren't always reliable. They get caught in a lot of whipsaws.

Divergence Trading Setups

Trading divergence is a way of looking at charts to guess when price trends might change direction. There are four kinds of divergences that can be traded using this trading indicator, which are explained in the divergence guide on this website.

Study More Lessons and Tutorials & Guides:

- The Mental Side & Important Rules for Successfully Trading Indices in the Market

- Build EURO STOXX 50 Strategy in Training Course

- Analysis of SMI Index Indicator

- Want to trade the Hang Seng Index? Here's how to get started.

- What's AS 51 Index Chart?

- Getting SWI20 in Your MT5 App

- How Can I Add AS 51 on MT5 iPhone Trade App?

- Best JP225 Strategies

- Things to Think About When Picking a Stock Index Trading Broker