RSI Indicator Divergence Setups

Divergence in indices is a trading setup utilized by traders. It entails analyzing a chart along with an additional indicator. We will utilize the RSI technical indicator for our example.

Spot divergence by finding chart points with new price highs or lows. The RSI fails to match, showing a split between price and momentum.

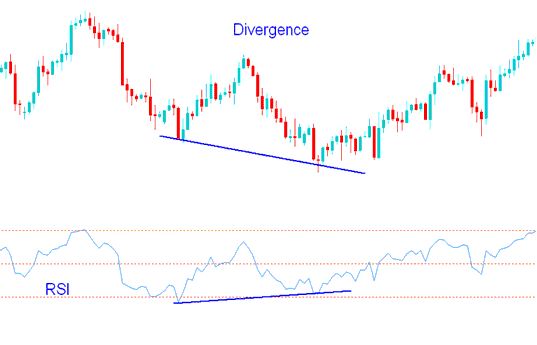

RSI Divergence Example:

On this chart, we mark two highs: point A and point B.

Then using RSI we check and analyze highs made and formed by the trading RSI, these are highs that are directly below the Chart points A & B.

We then plot one line on the chart & another line on the RSI.

RSI Divergence Trading Setup - Divergence Trading using RSI Indicator

How to identify a divergence

To identify this stock trade divergence setup, we must check for the following criteria:

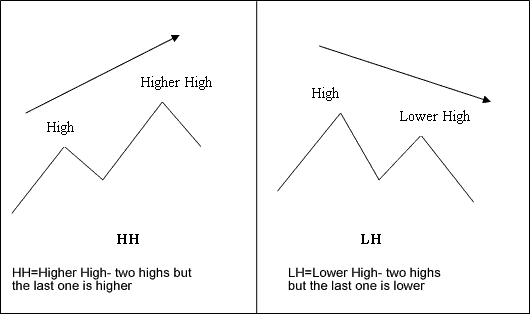

HH = Higher High - 2 highs but the last is higher

LH = Lower High : two highs but last is lower

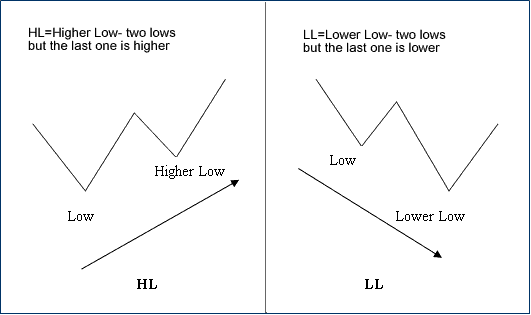

HL = Higher Low : 2 lows but last is higher

LL = Lower Low - 2 lows but last is lower

First let us look at the explanations of these trading terms

Divergence Terms Meaning

Divergence Terms Definition Example

There are 2 types of stock trade divergence setups:

- Classic Trading Divergence

- Hidden Trading Divergence Trading Setup

Study More Guides and Topics:

- Regulated Stock Index Trade Broker Review

- Advantages of MQL5 Copy Signals to Traders Over Other Copier Signals

- How to Add S&P ASX on MT5 Android App

- MACD Indices Trade Whipsaws Fake Outs: How to Avoid Types of Stock Indices Fake Out Signals

- How to Add DAX30 in MetaTrader 4 Android App

- How are Index Calculated in the Online Market?

- Index Account Equity Management

- How Do I Calculate Point Value AEX 25?

- Advantages of Trading Index over Forex Market

- How Can I Add SWI20 in MT4 Software Platform?