Methods of Setting Stop Loss Indices Orders in Stock Indices Trading

Traders using a indices trading system must have mathematical calculations that reveal where the order must be placed.

A trader can also place a stoploss order according to the indicators used to set these orders. Certain indicators use mathematical equations to calculate where the stop loss stock indices order should be set so as to provide an optimal exit point. These trading indicators can be used as the basis for setting these orders.

Other traders also place these orders according to a predetermined risk to reward ratio. This strategy of setting is dependent upon certain mathematical equations. For examples a ratio of 50 pips stop loss can be used by a trader if the trade has potential to make 100 pips in profit: this is a risk:reward ratio of 2:1

Others just use a predetermined percentage of their total account balance.

To set a stop loss order it's best to use one of the following methods:

1. Percent of Indices trading account balance

This is based on the percent of account balance that the trader is willing to risk when trading.

If a trader is willing to risk 2% of account balance then the trader decides how far he will set the order level based on the trade size that he has bought or sold.

Example:

If a trader has a $100,000 account and is willing to risk 2% then the position size of the trade that they will open for Indices will be determined by this 2% stop loss level.

2. Setting Stop Loss Indices Order using Support and Resistance Areas

Another way of setting stop loss stock indices orders is to use supports and resistance levels, on the trading charts.

Given that stop losses tend to congregate at key points, when one of these levels is touched by the indices price, others are set off, like dominos. Stoploss orders tend to accumulate just above or below the resistance or support levels, respectively.

A resistance or a support area should act like a barrier for stock indices price movement, this is why they are used to set stop losses, if this barrier is broken the stock indices price movement can go toward the opposite direction of the original indices trade, but if this barriers (support & resistance zones) aren't broken the stock indices price will continue heading in intended direction.

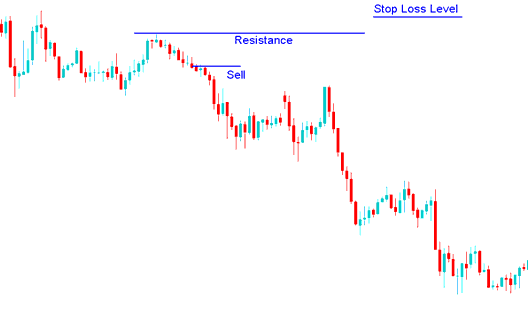

Stop Loss Indices Order level using a resistance zone

Setting order above the resistance

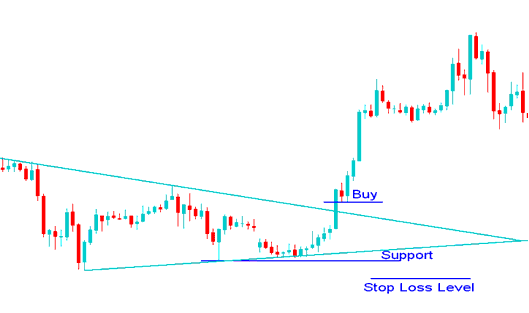

Stop Loss Indices Order level using a support Level

Setting order below the Support Line

3. Stock Indices Trendlines

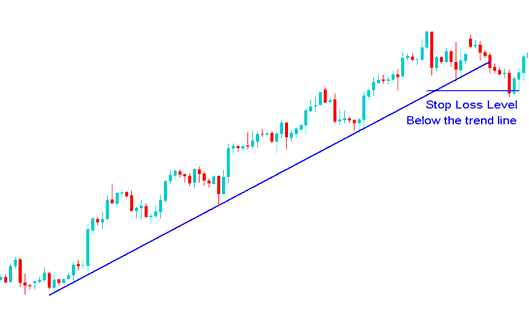

A indices trend line can be used to set stop losses where the order is set just below the trend line. As long as the trend line holds the trader will be able to continue making profits while at the same time set this order which will lock his profit once the trendline is broken.

Setting order below the trendline

Examples of where to set this order using indices trend lines.