Indicators for Setting Stoploss in Indices Trade

Some technical indicators help you set stop losses, which means you don't have to do a bunch of tricky math to figure out where to put your stop orders.

A systematic trader can also position a stop-loss order based on these indicators. Certain technical indicators employ mathematical formulas to ascertain the optimal placement for a stop-loss order to ensure an ideal exit point. These trading indicators serve as the foundation for setting stop-loss placements. They meticulously follow the price fluctuations of a traded instrument, defining the expected boundaries within which prices should fluctuate. If the price action ventures beyond these established limits, it is prudent to close any open positions, as the momentum in that specific direction is likely ceasing.

Some of the Indicators that can be used to set stop losses are:

Automatic Stop Loss Order and Take-Profit Indicator

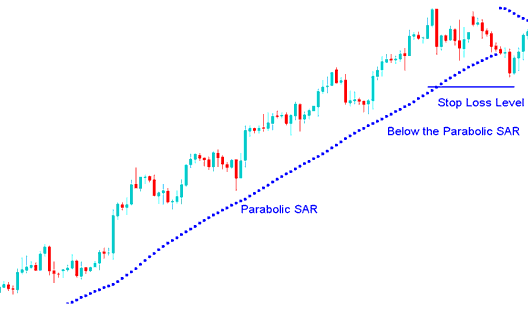

Parabolic SAR functions similarly to an automated indicator for setting a Stop Loss and Take Profit order, used for trailing stop prices.

Parabolic SAR provides excellent exit points.

When trading within an upward trend, long positions should be closed immediately if the price movement reverses and drops beneath the trailing Parabolic SAR indicator signal.

In downtrends, exit short positions here. Close when price tops the Parabolic SAR.

When you are in a long position, the price remains above the parabolic SAR, which will consistently move upwards each day, irrespective of the price direction. The extent to which the Parabolic SAR ascends is contingent upon the movement of stock trading prices.

Parabolic SAR - Indicator - Automatic Stop Loss Order and TP Order Indicator

Picture of parabolic SAR & how it's used

Indicator for Setting Stop Loss Orders

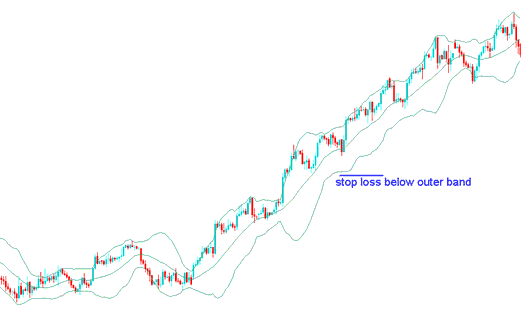

Bollinger Band indicator use standards deviations as an estimate of the volatility. Since standard deviation technical indicator is a measure of volatility, the Bollinger bands are self-adjusting meaning they widen during periods of higher volatility and contract during periods of lower market volatility.

The Bollinger Bands indicator has 3 bands that try to include most of the price changes of a trading item. The middle band is a guide for the market trend over time: it's usually a 20-period simple MA, which is also the basis for the upper and lower bands. How far the upper and lower bands are from the middle band depends on how much the price changes.

Because the Bollinger Bands cover the price's movement, they can be used to decide where to put stop loss orders beyond the band lines.

Bollinger Band Setting Stop Loss Order Level - Bollinger Band Technical indicator

Automatic Stop Loss Order & TP Indicator

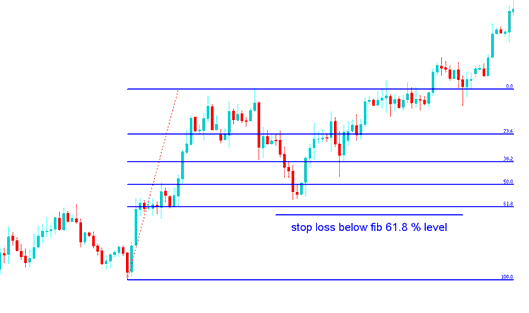

Fibonacci retracement levels provide areas of support & resistance, these can then be used to set stoploss order levels.

The 61.80% Fib Retracement level is the one most often used for placing stop loss orders. Put a stop loss order just below the 61.8% Fib retracement level.

The 61.80% Fibonacci retracement level is commonly employed to place orders, as it is infrequently attained.

Fib Indicator Stop Loss Order Setting at 61.80% Retracement Level

Fib retracement level 61.8% - Fib Indicator

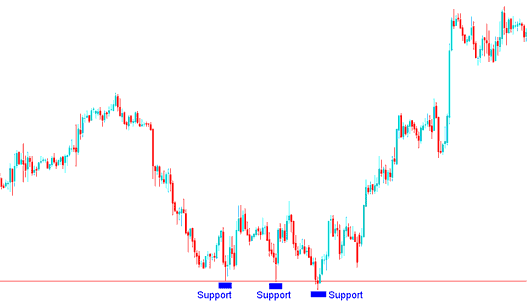

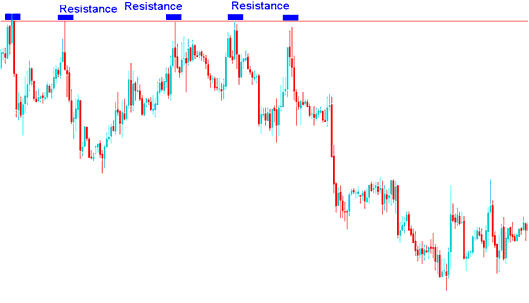

Support & Resistance Levels Lines

Support and resistance levels can be used to set levels for stoploss orders, where the stop loss orders are set just above or below the resistance/support.

- Buy Trade - Stop Loss Order set few pips below the support

Buy Trade - StopLoss set few pips just below the support

- Sell Trade - Stop Loss Order set a couple of pips above the resistance

Sell Trade - Stop-Loss Order set a few pips above the resistance

Study More Lessons and Tutorials and Topics:

- How Do Trade AS 51 Index Trading Strategy?

- Comparison of Fibonacci Levels and Fibo Pullback Levels

- Discover How to Invest in the Index Market

- Dow Jones Trading Strategies: Your Go-To Guide

- DeMark Range Extension Stock Indices Indices Indicator Analysis

- Three Steps to Boost Your Stock Index Results

- Commodity Channel Index Index Indicator Analysis

- How is FRA40 Traded on the MT5 Platform Online?

- Effective Trading Strategies for JP225

- Summary of the Bollinger Band Stock Index Trading Plan