Stop Loss Indices Order Trading Summary: Points To Remember When Placing

The key to putting stop orders in indices trading is not to put too tight or too far & not exactly on the support or resistance areas.

A few pips below the support or above the resistance levels is the best place.

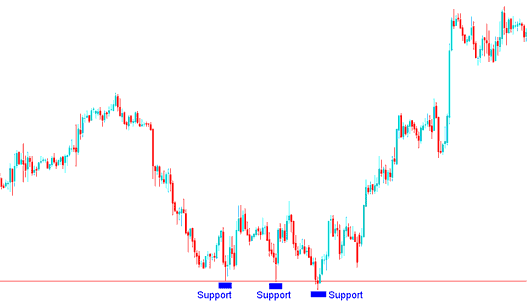

If you are going long (buying a indices trading instrument), just look for a nearby support level which is below your entry point & set this order about 10 pips to 20 pips below that support level. The example explained and illustrated below show the level where a trader can put their stop orders just below the support level on a stock indices chart.

Support Level for Putting Stop Loss Indices Order Level for Buy Trade

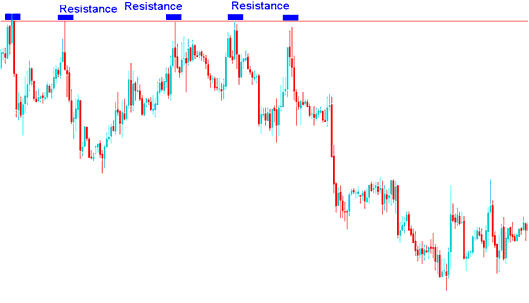

If you are going short (selling a indices trading instrument), just look for a nearby resistance level that is above your trade entry point and put this top loss order about 10 pips to 20 pips above that resistance level. The example explained and illustrated below show the level where a trader can set their stop loss orders just above the resistance level on a stock indices chart.

Resistance Level for Placing Stop Loss Indices Order Level for Sell Trade

You can also use stop loss stock indices orders to lock in profits, Not Just for Preventing Losses

The advantage of a stop loss stock indices order is that you do not have to monitor on a daily basis how the stock indices market is performing. This is especially handy when you are in a situation which prevents you from watching your transactions for an extended period of time, or when you want to navigate to sleep after trading the whole day.

The disadvantage is that the stock indices price at which you set these orders could be activated by a short-term fluctuation in stock indices price. The key is picking a stop loss order percent which allows stock indices price to fluctuate within the day to day range while capping the down side risks.

These stock indices orders are traditionally thought of as a way to cap losses thus the name. Another use of these stop loss orders is to lock in profits, in which case it's referred to as a trailing stop loss.

For a trailing stop order it is put at a percent level below the current market indices price. This trailing level then shifted as the trade position unfolds. Using a trailing stop loss level allows you to let profits run while at the same time ensures that should the stock indices trading market turn you'll have locked in some of your trading profits.

These stock indices orders can also be used to eliminate risk if a Indices trade transaction becomes profitable. If a trade transaction makes some substantial gains then the stop loss order can be moved to break even point, the point at which you opened buy, thereby ensuring that even if the trade position goes against you, you will not make any loss, you'll break even on that trade.

Trailing stop stock indices orders are used to maximize & protect profit as stock indices price rises and limit losses when the stock indices price falls.

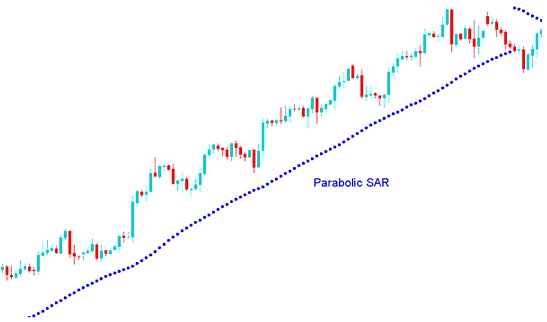

A good example is when you use the parabolic SAR Stock Indices Indicator & keep moving your stop order to the parabolic SAR level.

Parabolic SAR Indices Indicator for Placing Trailing Stop Loss Indices Order in Indices

Another example is where a trader moves his stop loss by a specific number of pips after every few hours or after every hour or after every 15 min depending on the Indices chart timeframe that the trader is using.

In the stock indices trading example above the parabolic SAR which had a setting of 2 and 0.02 was used as the trailing stop loss order for the above trading chart. The trader would have kept shifting the trailing stop loss level upwards after every SAR was drawn until the time when the Parabolic SAR Indicator was hit & the indices trend reversed.

Conclusion A stop order is a simple trading tool, yet so many investors fail to use it. Whether it is used to prevent excessive losses or to lock in profits, nearly all trading styles can benefit from this trading tool.

Points To Remember When Placing These Stop Loss Orders

Here are some important points to remember:

- Be careful with the points where you put these stop orders. If indices normally fluctuates 20 points, you don't want to set your stop order too close to that range else you'll be taken out by normal market volatility

- Stop Loss Indices Orders take the emotion out of a trading decisions & by setting one you set preset point of exiting a losing trade position, intended to control losses.

- Traders can always use indicators to calculate where to put these regions, or use the concepts of Resistance and Support to decide where to set these stop loss orders. Another good technical indicator used to set these stop loss orders is the Bollinger bands where traders use the upper & lower band as the limits of stock indices price therefore putting these orders outside the bands.