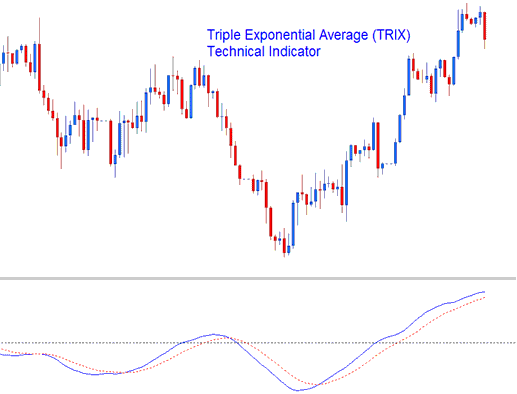

Triple Exponential Average Indices Technical Analysis & TRIX Trading Signals

Developed by Jack Hutson

TRIX is a triple smoothed oscillator that is designed to eliminate spikes that cause whipsaws in the calculations, these spikes or market cycles that are shorter than the selected indicator period used to calculate & draw are ignored.

Triple Exponential Average is an oscillator that oscillates above and below a center line mark. The center line level is used to determine bullish and bearish trends. TRIX will measure the momentum of an up indices trend or a down indices trend. Above the center-line shows bullish trends & below the center-line shows bearish trends

Stock Indices Technical Analysis & How to Generate Trading Signals

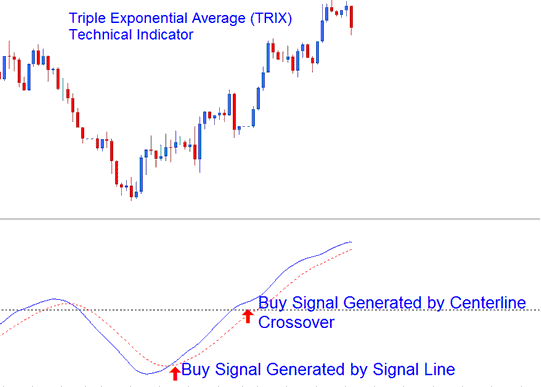

Bullish Buy Trading Signal

A buy stock indices signal can be generated using 2 techniques:

- The first one is the center-line cross over signal where values above the line are bullish.

- The second one is used to generate a signal when the signal line crosses above TRIX line.

Bullish Buy Trading Signal

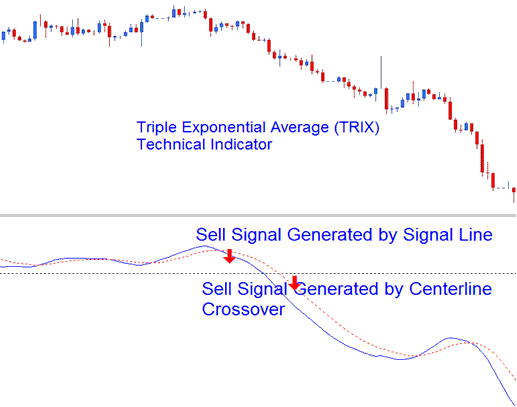

Bearish Sell Trading Signal

A sell stock indices signal can be generated using 2 techniques:

- The first one is the center-line cross over signal where values below the line are bearish.

- The second one is used to generate a trading signal when the signal line crosses below TRIX line.

Bearish Sell Trading Signal

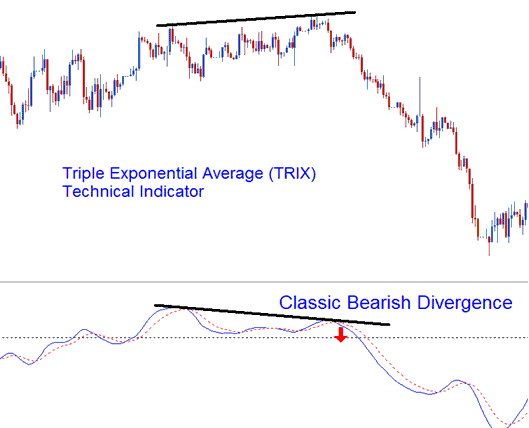

Divergence Indices Trading

Divergence can be used to generate trading signals. Traders can look for divergence between stock indices price & the indicator & decide which direction to trade.

Divergence Stock Indices Trading