Indices Price Breakout after Double Bottoms Pattern

Double bottom stock indices pattern is a reversal stock indices chart setup which forms after an extended down-wards indices trend.

Double bottom stock indices chart setup is made up of 2 consecutive troughs that are roughly equal, with a moderate peak between the 2 troughs.

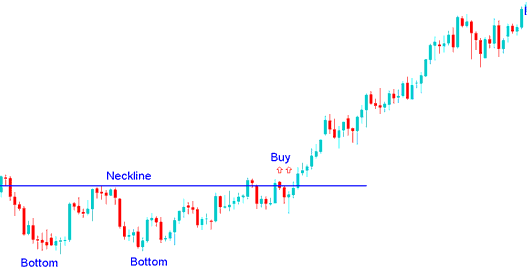

The buy stock indices signal from this double bottoms stock indices chart pattern market bottoming out stock indices signal occurs when the stock indices trading market breaks-out the neckline to the upside.

In Indices, the double bottom stock indices pattern is an early warning stock indices signal that the bearish Indices trend is about to reverse.

Double Bottoms Pattern is only considered complete/confirmed once the neckline is broken.

In this double bottoms stock indices chart patterns formation the neckline is the resistance level for the indices price. Once this resistance is broken the stock indices trading market will move up.

Summary:

- Double bottom stock indices chart setup forms after an extended move downwards - indices downwards trend

- This Double bottom stock indices chart setup formation indicates that there will be a reversal in stock indices trading market

- We buy when stock indices price breaks-out above neck line: as described on the stock indices trading examples explained below.

What Happens to Indices Price Action After a Double Bottoms Chart Setup?

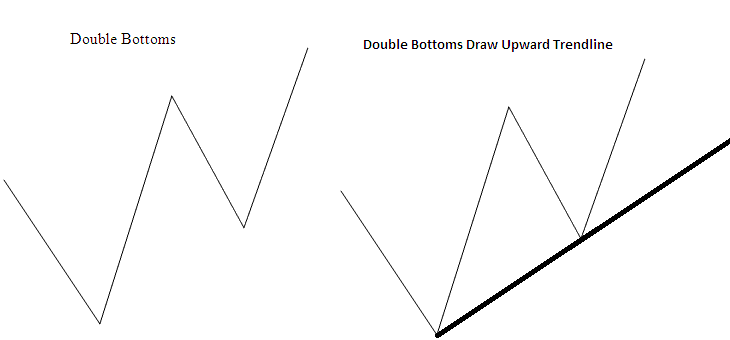

The double bottom stock indices pattern look like a W-Shape stock indices chart pattern, the best reversal stock index signal is where the second bottom is higher than the first bottom as displayed and shown below.

This means that the reversal stock indices signal from the double bottoms stock indices chart pattern can be confirmed by drawing an upward indices trendline as shown below. If a trader opens a buy stock indices signal the stop loss will be placed just below this up-wards trendline.

What Happens to Indices Price Action After a Double Bottoms Chart Pattern in Indices Trading