Indices Price Breakout after Inverse Head and Shoulders Pattern

Inverse Head and shoulders Stock Indices Pattern

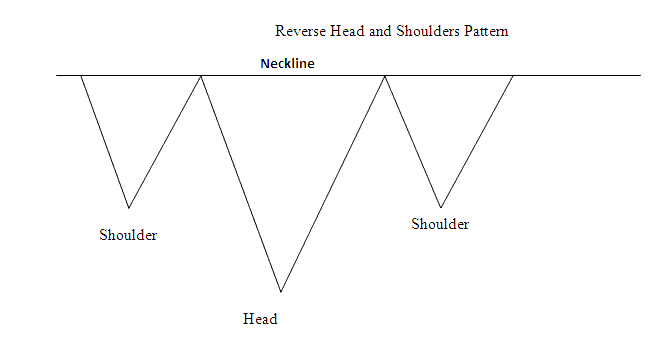

Inverse Head & Shoulders Chart Pattern is a reversal head and shoulders stock indices pattern setup which forms after an extended Indices Trading downwards trend. It resembles an up-side down head shoulders.

Inverse Head & Shoulders Pattern is considered complete once stock indices price penetrates above the neckline, which is drawn by joining these two peaks between the reverse shoulders pattern setup.

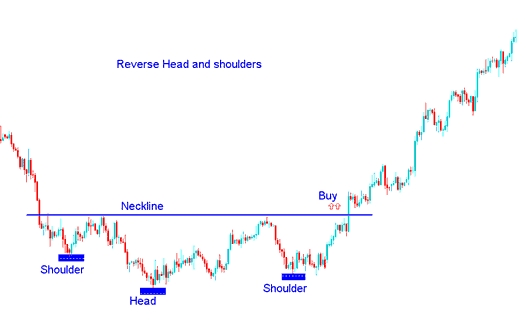

Traders open buy stock indices trades using this reversal trading signal once the stock indices price closes above the neckline.

Summary:

- Inverse Head and Shoulders Pattern forms after an extended move downward

- Inverse Head & Shoulders Pattern indicates that there will be a reversal in stock indices trading market

- Inverse Head & Shoulders Pattern formation resembles upside-down, thus its name Inverse Head and Shoulders Chart Pattern.

- We buy when stock indices price breaks-out above neck line: as described on the stock indices trading examples explained below.

What Happens to Indices Price Action After a Reverse Head and Shoulders Pattern?

Examples of Inverse Head and Shoulders Chart Pattern on a Indices Chart

Indices Price Breakout after Inverse Head and Shoulders Pattern