What Happens when a Indices Trend Line is Broken?

What Happens when a Trendline is Broken?

The indices trendline break - when a trendline is broken it is a stock indices reversal signal where the stock indices trading market goes through the trend line & starts heading in the opposite direction.

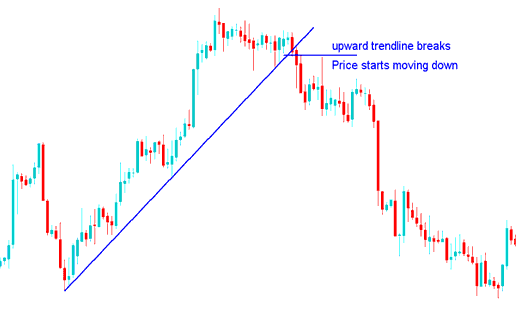

What Happens when an Upward Stock Indices Trendline is Broken?

When a trendline is broken in an upward indices trend - when a trendline is broken then sentiment of the stock indices trading market reverses & becomes bearish

What Happens when an Upwards Indices Trendline is Broken - What Happens when a Indices Trendline is Broken?

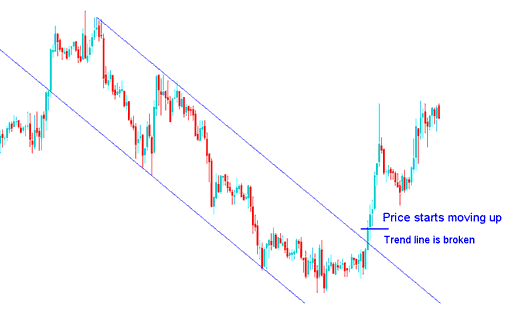

What Happens in Stock Indices after Downward Stock Indices Trendline is Broken?

When a trendline is broken in a downward indices trend - when a trendline is broken then sentiment of the indices reverses & becomes bullish

What Happens in Indices Trading after a Indices Trendline is Broken?

NB: for very strong indices trends, when a trendline is broken the stock indices price will consolidate for some time before moving in opposite trend direction. For short term stock indices market trends when a trendline is broken it will mean stock indices price may reverse immediately.