How Can I Tell a Bearish Indices Trend?

Explain How to Identify Indices Trading Down Trend Market Direction

How Can I Tell a Bearish Indices Trend? - How Can I Define a Bearish Indices Trend?

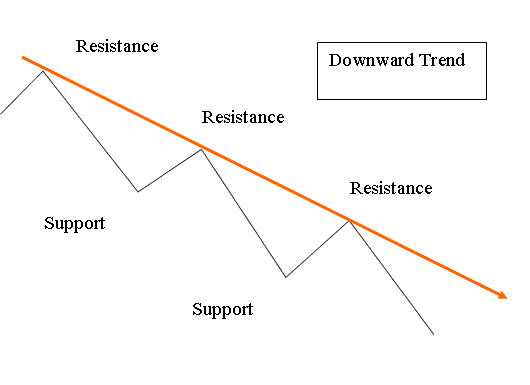

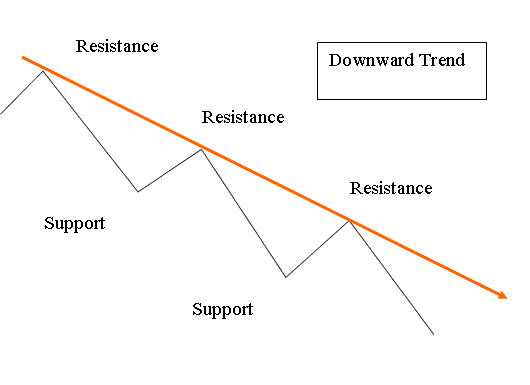

A bearish indices trend or a downwards indices trend is defined by indices prices closing with lower highs and lower lows. This is the definition of a bearish indices trend.

The example explained and illustrated below defines the bearish indices trend setup

Simple Way to Identify Indices Trading Bearish Indices Trend & Downward Indices Trends

Indices Trend is the stock indices trading market tendency of stock indices prices to move in a particular direction for a period of time

For a Downward indices trend the stock indices price will move in a general market direction downwards.

This means indices prices will close lower than where they opened.

How Do I Identify Indices Downward Trend?

A downward indices trendline is plotted above the downward indices trend setup formed by consecutive lower highs, the downwards indices trendline must connect at least 2 highs, with the most recent high being lower. For our down indices trend examples we shall use the MT4 analysis software charts to illustrate example of the downwards trend.

Since stock indices price moves downwards in a zigzag manner indices traders normally draw a downward indices trendline which shows the general downward indices trend direction. In stock indices technical analysis, this general direction is referred to as the TREND by stock indices traders. In analysis definition we can define this down indices trendline is plotted on Indices chart showing the resistance areas (bearish market direction).

Explain How to Identify Indices Trading Down Trend Market Direction

A indices trading down trend bearish market indices trend occurs when the stock indices price forms a series of lower highs & lower lows. Each price high is lower than previous high - lower high, and each low is lower than previous low - lower low therefore showing bearish stock indices price trend movement.

Down indices trend indices trendlines gain more validity every time stock indices price touches the downwards indices trend line but doesn't penetrate the downwards indices trend line. A down trend bearish market remains the general trend direction until this sequence of lower highs and lower lows is broken -indices trendline break.