What's an Example of a Indices Trend? Identifying Trends in Indices Trading

A indices trend in indices trading is the tendency of indices prices to move in a particular direction for a period of time in a general direction upward or downward.

Trends can be interpreted using indices trend lines.

Indices Trend line analysis helps traders to define the direction of the market. Indices Trend lines connect a series of stock indices price highs or stock indices price lows forming a sloping indices trend which represents the general movement of the stock indices price.

For an upwards sloping line this is referred to as an up indices trend - trend-line drawn is referred to as an upward indices trend line.

For a downwards sloping line this is known as an down indices trend - the trend line drawn is known as an downward indices trend-line.

Up-ward Stock Indices Trend Line

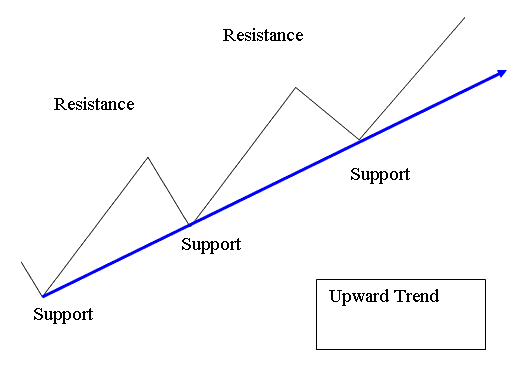

An upwards indices trendline is drawn below upward sloping pattern by connecting at least two lows. This will draw a indices trendline that show the general direction of the market upward.

The example explained and illustrated below shows how stock indices price moves when it is heading in an upward trend. The stock indices price will move upward forming support zones.

Since the stock indices trading market moves in a zigzag manner indices traders normally draw a indices trend-line which highlights the general upwards indices trend direction.

What's an Examples of a Indices Trend? Identifying Trends in Indices Trading - Indices Trend Definition

An up indices trend occurs when the stock indices price makes consecutive higher stock indices price highs & higher stock indices price lows. Each stock indices price high is higher than the previous stock indices price high - higher high, and each stock indices price low is higher than the previous stock indices price low - higher low.

Up indices trend-lines gain more validity each time stock indices price touches but doesn't penetrate it. An up indices trend remains in place until this series of higher stock indices price highs & higher stock indices price lows is broken -indices trend-line break reversal signal.

Downward Stock Indices Trend Line

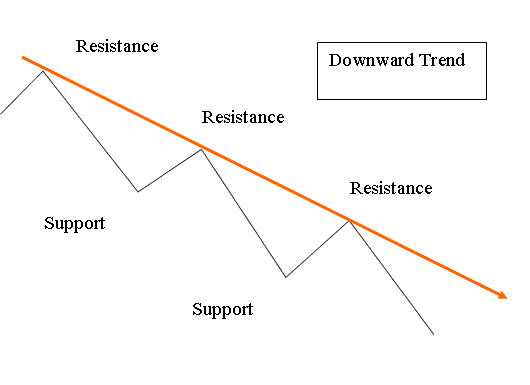

A downward indices trend-line is drawn above pattern setup formed by consecutive lower highs, it must connect at least two highs, with most recent high being lower.

Since stock indices price moves down ward in a zigzag manner traders normally draw a line which highlights the general downwards direction. In stock index market technical analysis, this general direction is known as the Indices Trading TREND by stock indices traders. This down indices trend-line is drawn on Indices chart showing the resistance areas (bearish indices trend market direction).

What's an Examples of a Indices Trend? Identifying Trends in Indices Trading - Indices Trend Definition

A down indices trend occurs when the stock indices price forms a series of lower highs & lower lows. Each stock indices price high is lower than the previous stock indices price high - lower high, and each stock indices price low is lower than the previous stock indices price low - lower low therefore showing bearish stock indices price movement.

Down indices trend-lines gain more validity each time stock indices price touches but doesn't penetrate the trend-line. A down trend remains the general direction until this series of lower stock indices price highs & lower stock indices price lows is broken -indices trend-line break reversal signal.