Where Should I Place a Stop Loss Indices Order using Bollinger Bands Indices Indicator?

How to Set a Stop Loss Indices Order using Bollinger Bands Indicator

Bollinger Bands Indicator

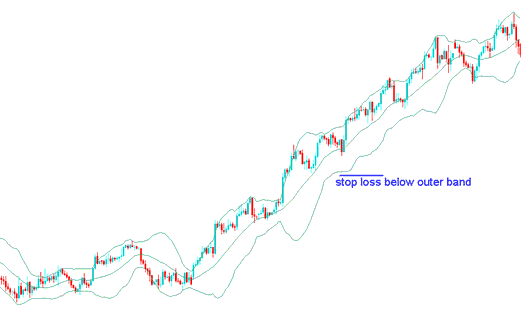

Bollinger bands stock indices technical trading indicator use standard deviation as a measure of volatility. Since standard deviation indicator is a measure of volatility, bands are self adjusting which means they widen during the periods of higher volatility and contract during the periods of lower volatility.

Bollinger Band consist of 3 bands designed to encompass the majority of a trading instruments stock indices price action. The middle band is a basis for the intermediate term trend, typically it is 20 period simple moving average, which is also the base for upper and lower bands. The upper band's distance and lower band's distance from the middle band is determined by volatility of trading price.

Since these Bollinger bands are used to encompass the trading instrument stock indices trading price action, the bands can be used to set stop loss orders outside the areas of the bands.

How to Set a Stop Loss Indices Order using Bollinger Bands Technical Indicator