Williams Percent Range Analysis: Utilizing Percent Range Signals for Better Trades

William %R Indicator Created by Larry Williams

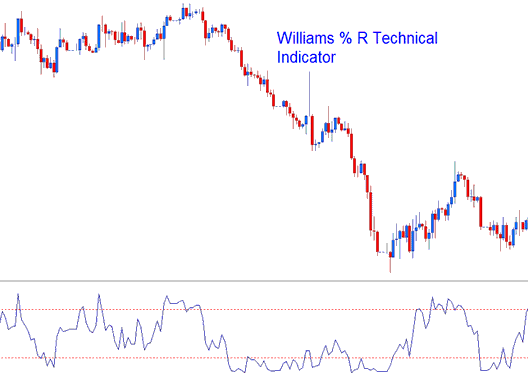

The William %R indicator is referred to as the William percent R technical indicator. This momentum oscillator is employed for analyzing whether the markets are overbought or oversold.

The Williams %R works like the Stochastic. But it flips upside down on a scale from 0 to -100. It skips any smoothing step.

William %R, Percent R Technical Stock Indicator - Indicators

The Williams %R technical indicator looks at how the closing prices relate to the highest and lowest prices over a selected number of n individual candle sticks.

- The closer the closing price of a candlestick is to the highest high of the range chosen the closer to zero the Percentage R reading will be.

- The closer the closing price of a candlestick is to the lowest low of the range selected the closer to -100 the %R reading and value will be.

In technical analysis for stock indexes, skip the minus sign on values. Take -40 as 40. Remember, readings flip upside down in this setup.

- At zero: If the closing price of the candlestick is equal to the highest high of the range the Williams %R reading will be 0.

- At -100: if the closing price of the candle is equivalent to the lowest low of the range the Williams %R value will be -100.

William Percent Range Indicator

Overbought/Oversold Levels in Indicator

- Overbought- Williams Percentage R values from Zero to -20 are regarded and considered over-bought while

- Oversold - Williams Percentage R values from -80 to -100 are considered oversold.

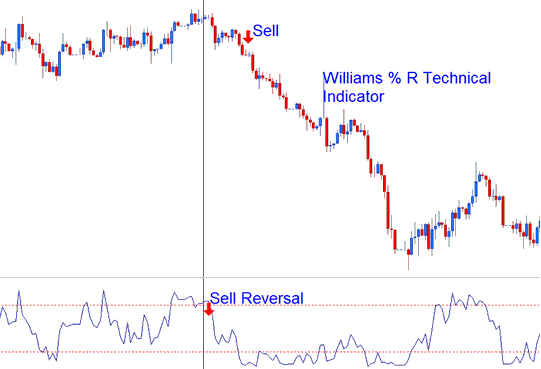

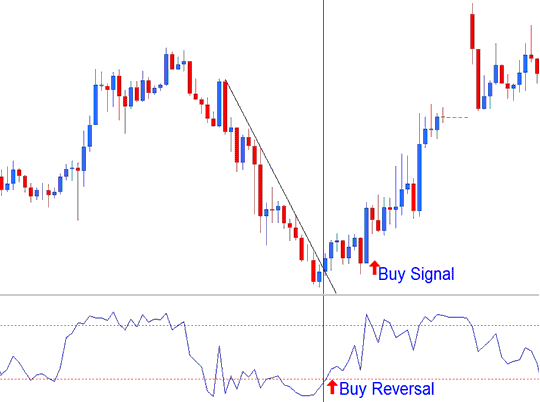

As for overbought/oversold levels it is best to wait for indices to change direction before taking a signal in the opposite trend direction. For Example if indices is oversold it is best to wait for the trend to reverse and start to head in an upward direction before buying indices.

Trend Reversal Signals

The William %R indicator used to predict a trend reversal signal when trading indices. The William % R technical indicator always predicts a reversal using the following method

Bearish Reversal Signal- William Percentage R trading indicator forms a peak and turns down a couple of days before the price trend peaks and turns down. The example expounded & shown below shows %R giving a reversal signal before price starts to head down and change to a down-trend.

Bearish Reversal Indices Trade Signal after Uptrend

Williams %R bullish reversal: It forms a low and rises just before price bottoms and turns up.

Bullish Reversal Indices Trade Signal after Downtrend

Explore Further Programs & Instructions: